08-31-2023

| PHP/share | |

| Price | 104.50 |

| Dividend | 1.40 |

| Earnings | -5.02 |

| Cash-flow | -1.66 |

| Book value | 116.11 |

| Equity | 125.50 |

San Miguel is part of Beverages business, which is part of Consumer Goods industry. San Miguel is a company from Philippines, and his stocks are publicly traded.

San Miguel stock dividend

San Miguel paid a total dividend of 3,338 million PHP last year, for a market value of 249,128 millions (Market Cap 37,980 millions). San Miguel dividend per share is 1.40 PHP, and his stock market price 104.50 PHP.

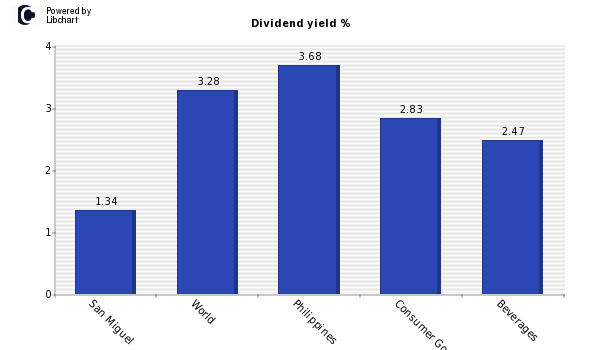

According to the chart below, where dividend yield is displayed, San Miguel has a dividend yield of 1.34%, lower than the amount offered by both the market average and companies from Philippines. It is also lower than average of Consumer Goods industry. This low dividend yield might has several explanations: company overpriced, expanding their business,...

In addition, you should compare San Miguel stocks dividend with other Beverages companies or other of the high Philippines dividend stocks list.

San Miguel Dividend Payout

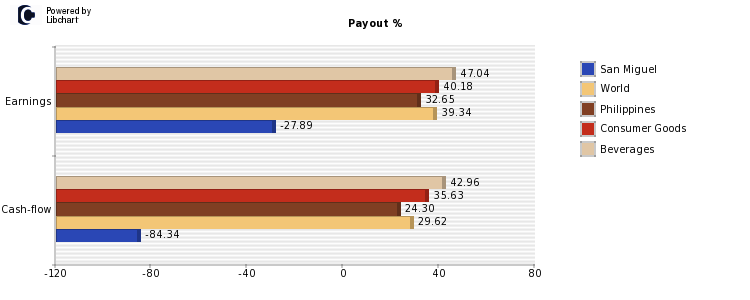

About the ability of San Miguel to maintain his current dividend of PHP 1.40 per share, an amount that accounts for 1.34%, we should study its payout ratio both on earnings and on cash-flows (see chart below). San Miguel payout on ernings is currently -27.89%, which is lower than the market average and companies of Consumer Goods industry, which are 39.34% and 40.18% respectively. Both figures lead us to believe that there is confidence that San Miguelcan maintain his current dividend.

The payout on earnings should be complemented with the payout on cash flow since it is this last amount the one which can be distributed to shareholders. Cash flow per share of San Miguel is PHP -1.66 per share, which is lower than the dividend per share paid by the company of PHP 1.40, so the company does not generate enough cash to maintain his dividend in the future.

The following figure shows payout ratios over earnings and cashflow of San Miguel, compared againt world market average, Philippines companies, Consumer Goods industry and Beverages sector companies.

San Miguel Dividend History

Below you will find a table with the historical evolution of San Miguel's dividend stock, both in percentage and in PHP, its Payout on Earnings and the number of shares (in case there is an split, number shares altered the dividend per share).

| Year | Yield | PHP | Paypout | Shares* |

| Present | 1.34% | 1.40 | -27.89% | 2,384 |

| 2022 | 1.51% | 1.40 | 27.56% | 2,384 |

| 2021 | 1.22% | 1.40 | 0.00% | 2,384 |

| 2020 | 1.09% | 1.40 | 17.37% | 2,384 |

| 2019 | 0.85% | 1.39 | 15.60% | 2,379 |

*In millions

San Miguel Stock performance

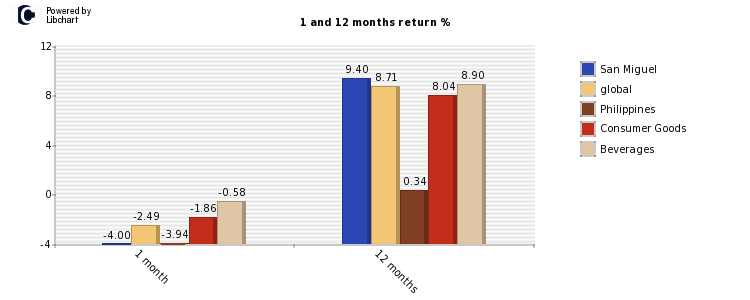

Finally, last moth San Miguel showed a return of -4.00% compared to a worldwide -2.49% average, and a -1.86% of Consumer Goods firms. Over the last year, the company obtained a 9.40% versus a worldwide performance of a 8.71%. More detailed information can be seen in the following graph for Philippines and Beverages firms.