Best S&P 100 dividend stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

S&P 100 highest dividend stocks and full list ranked by diviend yield (USA 1.99% average)

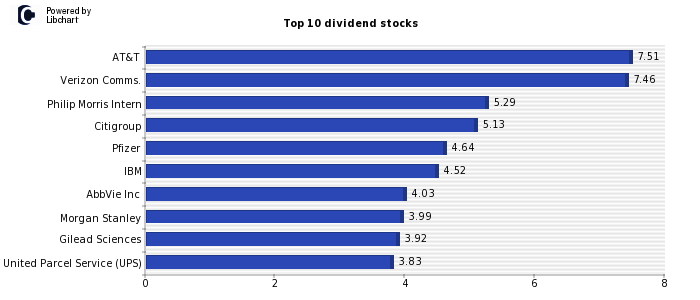

It can be seen, AT&T (Fixed Line Telecommunications) - Verizon Comms. (Fixed Line Telecommunications) - Philip Morris Intern (Tobacco) - are the companies that currently pay a higher dividend in the S&P100, offering returns of 7.51% - 7.46% - 5.29% - respectively.

S&P 100 is a stock index of the United States. It consists of the 100 largest companies listed on the stock exchanges of the United States. It is one of the benchmarks used by the company Standard & Poor's, one of the three major credit rating agencies.Its stock symbol is OEX.

You can also access the list of the best dividend growth stocks in the USA in the last 5 years or the full list of the highest US dividend stocks.

Then, we present the S&P100 and the complete list of stocks that compose it, including their market Cap, paypout and dividend yield.

Full S&P100 Index Dividend stocks list

| Company | Dividend | Payout | Market Cap (mn) | Sector |

| AT&T | 7.51% | -91.74% | USD 105,753 | Fixed Line Telecommunications |

| Verizon Comms. | 7.46% | 46.28% | USD 147,023 | Fixed Line Telecommunications |

| Philip Morris Intern | 5.29% | 85.67% | USD 148,887 | Tobacco |

| Citigroup | 5.13% | 29.28% | USD 80,203 | Banks |

| Pfizer | 4.64% | 26.41% | USD 199,660 | Pharmaceuticals and Biotechnology |

| IBM | 4.52% | 146.90% | USD 133,246 | Software and Computer Services |

| AbbVie Inc | 4.03% | 53.57% | USD 259,012 | Pharmaceuticals and Biotechnology |

| Morgan Stanley | 3.99% | 53.88% | USD 102,243 | Financial Services |

| Gilead Sciences | 3.92% | 58.48% | USD 95,469 | Pharmaceuticals and Biotechnology |

| United Parcel Service (UPS) | 3.83% | 46.72% | USD 122,519 | Industrial Transportation |

| Chevron | 3.75% | 32.99% | USD 284,690 | Oil and Gas Producers |

| CVS Health Corporati | 3.71% | 51.93% | USD 83,342 | Food and Drug Retailers |

| Bristol Myers Squibb | 3.70% | 29.96% | USD 129,436 | Pharmaceuticals and Biotechnology |

| American Tower Corp | 3.46% | 84.39% | USD 84,302 | Real Estate Investment Trusts |

| Wells Fargo & Co. | 3.39% | 42.68% | USD 155,860 | Banks |

| Medtronic plc | 3.39% | 67.32% | USD 108,115 | Health Care Equip. and Services |

| Goldman Sachs Group | 3.36% | 33.60% | USD 105,670 | Financial Services |

| Bank of America | 3.35% | 29.45% | USD 199,451 | Banks |

| Amgen Corp | 3.32% | 49.80% | USD 136,763 | Pharmaceuticals and Biotechnology |

| Exxon Mobil Corp | 3.27% | 26.51% | USD 451,100 | Oil and Gas Producers |

| Coca-Cola | 3.08% | 82.51% | USD 232,730 | Beverages |

| Texas Instruments | 2.95% | 51.35% | USD 152,365 | Technology Hardware and Equip. |

| Johnson & Johnson | 2.94% | 51.41% | USD 389,167 | Pharmaceuticals and Biotechnology |

| Blackrock Inc | 2.85% | 56.16% | USD 103,999 | Financial Services |

| Pepsico | 2.84% | 76.63% | USD 244,803 | Beverages |

| NextEra Energy Inc | 2.80% | 90.78% | USD 135,058 | Electricity |

| Prologis | 2.80% | 93.05% | USD 114,435 | Real Estate Investment Trusts |

| Qualcomm | 2.79% | 26.53% | USD 127,612 | Technology Hardware and Equip. |

| Raytheon Technologies | 2.74% | 48.26% | USD 125,572 | Aerospace and Defense |

| JPMorgan Chase & Co | 2.73% | 28.91% | USD 427,285 | Banks |

| Cisco Systems | 2.72% | 47.27% | USD 234,862 | Technology Hardware and Equip. |

| Merck & Co | 2.68% | 44.24% | USD 276,471 | Pharmaceuticals and Biotechnology |

| Lockheed Martin Corp | 2.68% | 48.80% | USD 101,258 | Aerospace and Defense |

| Home Depot | 2.53% | 49.61% | USD 334,094 | General Retailers |

| Comcast A | 2.48% | 46.40% | USD 193,117 | Media |

| Procter & Gamble | 2.44% | 59.37% | USD 362,904 | Household Goods and Home Constr. |

| Union Pacific Corp | 2.36% | 45.34% | USD 134,279 | Industrial Transportation |

| Honeywell Intl Inc | 2.19% | 49.76% | USD 124,971 | General Industrials |

| Starbucks | 2.18% | 69.97% | USD 109,794 | Travel and Leisure |

| McDonalds Corp | 2.16% | 67.15% | USD 204,787 | Travel and Leisure |

| Mondelez Internation | 2.16% | 73.68% | USD 96,781 | Food Producers |

| Broadcom | 1.99% | 48.77% | USD 376,234 | Technology Hardware and Equip. |

| Abbott Laboratories | 1.98% | 39.61% | USD 177,904 | Pharmaceuticals and Biotechnology |

| Automatic Data Proc. | 1.96% | 54.48% | USD 105,166 | Support Services |

| Lowes Cos Inc | 1.91% | 40.67% | USD 137,370 | General Retailers |

| Analog Devices | 1.89% | 36.52% | USD 91,777 | Technology Hardware and Equip. |

| Caterpillar | 1.85% | 38.46% | USD 145,001 | Industrial Engineering |

| Cigna Corp | 1.78% | 17.63% | USD 80,552 | Health Care Equip. and Services |

| ConocoPhillips | 1.71% | 13.20% | USD 144,143 | Oil and Gas Producers |

| Ace Ltd | 1.71% | 25.45% | USD 82,687 | Nonlife Insurance |

| Chubb Ltd | 1.71% | 25.45% | USD 82,687 | Nonlife Insurance |

| Schlumberger | 1.70% | 38.17% | USD 83,888 | Oil Equipment Services and Distrib. |

| Schwab (Charles) Cp | 1.69% | 23.64% | USD 87,554 | Financial Services |

| Unitedhealth Group | 1.58% | 31.28% | USD 442,450 | Health Care Equip. and Services |

| Amer. Express Co | 1.52% | 24.00% | USD 93,353 | Financial Services |

| Eaton Corp PLC | 1.49% | 46.16% | USD 91,620 | General Industrials |

| Marsh & Mclennan | 1.46% | 41.67% | USD 96,387 | Nonlife Insurance |

| TJX Companies | 1.44% | 43.75% | USD 106,375 | General Retailers |

| Intel Corp | 1.42% | 21.10% | USD 146,516 | Technology Hardware and Equip. |

| WalMart | 1.40% | 52.78% | USD 231,813 | General Retailers |

| Accenture Cl A | 1.38% | 39.91% | USD 204,321 | Support Services |

| Nike Inc Cl B | 1.34% | 40.00% | USD 120,794 | Personal Goods |

| Anthem | 1.34% | 20.63% | USD 104,649 | Health Care Equip. and Services |

| Oracle Corp. | 1.33% | 35.71% | USD 182,825 | Software and Computer Services |

| Linde plc | 1.32% | 53.23% | USD 189,631 | Chemicals |

| Deere & Co | 1.22% | 20.36% | USD 111,923 | Industrial Engineering |

| Stryker | 1.06% | 38.20% | USD 100,597 | Health Care Equip. and Services |

| Lam Research | 0.98% | 20.28% | USD 94,104 | Technology Hardware and Equip. |

| S&P Global | 0.92% | 27.82% | USD 125,228 | Financial Services |

| Applied Materials | 0.84% | 16.52% | USD 128,787 | Technology Hardware and Equip. |

| Microsoft Corp | 0.83% | 27.06% | USD 2,436,276 | Software and Computer Services |

| Lilly (Eli) & Co | 0.82% | 63.14% | USD 468,423 | Pharmaceuticals and Biotechnology |

| Zoetis | 0.79% | 30.26% | USD 88,063 | Pharmaceuticals and Biotechnology |

| Costco Wholesale Cp | 0.74% | 30.83% | USD 243,051 | General Retailers |

| Visa | 0.73% | 23.74% | USD 397,356 | Financial Services |

| Intuit | 0.58% | 29.10% | USD 147,826 | Software and Computer Services |

| MasterCard Cl A | 0.55% | 21.02% | USD 345,766 | Financial Services |

| Apple Inc. | 0.51% | 15.24% | USD 2,800,237 | Technology Hardware and Equip. |

| Danaher Corp | 0.41% | 9.34% | USD 174,195 | General Industrials |

| General Electric | 0.28% | 23.53% | USD 123,933 | General Industrials |

| Thermo Fisher Scient | 0.25% | 5.74% | USD 214,653 | Health Care Equip. and Services |

| Nvidia | 0.03% | 0.00% | USD 1,171,291 | Technology Hardware and Equip. |

| Amazon.Com | 0.00% | 0.00% | USD 1,241,862 | General Retailers |

| Alphabet Class A | 0.00% | 0.00% | USD 808,193 | Software and Computer Services |

| Tesla Motors | 0.00% | 0.00% | USD 711,196 | Automobiles and Parts |

| Alphabet Class C | 0.00% | 0.00% | USD 706,470 | Software and Computer Services |

| Facebook Class A | 0.00% | 0.00% | USD 653,665 | Software and Computer Services |

| Berkshire Hathaway B | 0.00% | 0.00% | USD 466,627 | Nonlife Insurance |

| Adobe Systems Inc | 0.00% | 0.00% | USD 255,969 | Software and Computer Services |

| Salesforce.com | 0.00% | 0.00% | USD 209,355 | Software and Computer Services |

| Netflix Inc | 0.00% | 0.00% | USD 189,934 | General Retailers |

| Advanced Micro Devices | 0.00% | 0.00% | USD 169,246 | Technology Hardware and Equip. |

| Disney (Walt) Co. | 0.00% | 0.00% | USD 152,833 | Media |

| Boeing | 0.00% | 0.00% | USD 124,764 | Aerospace and Defense |

| ServiceNow | 0.00% | 0.00% | USD 119,732 | Software and Computer Services |

| Booking Holdings | 0.00% | 0.00% | USD 115,057 | Travel and Leisure |

| Intuitive Surgical | 0.00% | 0.00% | USD 109,065 | Health Care Equip. and Services |

| Uber Technologies | 0.00% | 0.00% | USD 91,480 | General Retailers |

| Vertex Pharm | 0.00% | 0.00% | USD 89,623 | Pharmaceuticals and Biotechnology |

| Regeneron Phar | 0.00% | 0.00% | USD 85,518 | Pharmaceuticals and Biotechnology |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.