Best USA Dividend Growth stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

12-31-2021

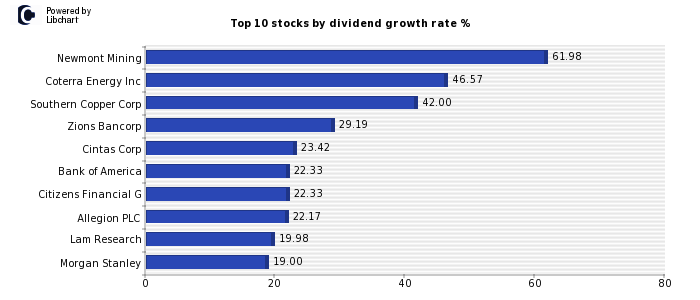

Best USA Dividend growth stocks ordered by 5y average dividend growth rate

As shown above, Newmont Mining (Mining) - Coterra Energy Inc (Oil and Gas Producers) - Southern Copper Corp (Industrial Metals and Mining) - are the companies that currently offer a highest dividend growth rate, offering dividend yields of - 61.98% - 46.57% - 42.00% - respectively.

Finally, there are also other USA zone stocks that offer a very interesting dividend growth rate such as - Zions Bancorp (Banks) - Cintas Corp (Support Services) - Bank of America (Banks) - Citizens Financial G (Banks) - .

You can also access the list of the best SP 500 dividend stocks, the best SP 100 dividend stocks or the highest US dividend stocks.

Coming up next, we show the full list of the best 5 year average dividend growth stocks traded in the USA, including their dividend yield and 5y average dividend growth rate.

Full list of the highest US dividend growth sotcks

| Company | Dividend | 5y avg. Growth* | Sector |

| Newmont Mining | 3.55% | 61.98% | Mining |

| Coterra Energy Inc | 6.32% | 46.57% | Oil and Gas Producers |

| Southern Copper Corp | 6.48% | 42.00% | Industrial Metals and Mining |

| Zions Bancorp | 2.41% | 29.19% | Banks |

| Cintas Corp | 0.86% | 23.42% | Support Services |

| Bank of America | 1.89% | 22.33% | Banks |

| Citizens Financial G | 3.30% | 22.33% | Banks |

| Allegion PLC | 1.09% | 22.17% | Electronic and Electrical Equipment |

| Lam Research | 0.83% | 19.98% | Technology Hardware and Equip. |

| Morgan Stanley | 2.85% | 19.00% | Financial Services |

| American Tower Corp | 1.90% | 18.81% | Real Estate Investment Trusts |

| Unitedhealth Group | 1.16% | 18.43% | Health Care Equipment and Services |

| Best Buy Company | 2.76% | 18.31% | General Retailers |

| Texas Instruments | 2.44% | 18.23% | Technology Hardware and Equip. |

| Zoetis | 0.41% | 18.20% | Pharmaceuticals and Biotechnology |

| D.R. Horton Inc | 0.83% | 17.69% | Household Goods and Home Constr. |

| Lowes Cos Inc | 1.24% | 16.67% | General Retailers |

| Home Depot | 1.59% | 16.39% | General Retailers |

| Amphenol Corp A | 0.91% | 16.29% | Electronic and Electrical Equipment |

| MasterCard Cl A | 0.49% | 16.08% | Financial Services |

| Visa | 0.69% | 15.96% | Financial Services |

| Tyson Foods Inc A | 2.11% | 15.93% | Food Producers |

| Goldman Sachs Group | 2.09% | 15.64% | Financial Services |

| Constellation Brands | 1.21% | 15.00% | Beverages |

| Snap-On Inc | 2.64% | 14.92% | Household Goods and Home Constr. |

| Tractor Supply | 0.87% | 14.90% | General Retailers |

| Baxter Intl | 1.30% | 14.65% | Health Care Equipment and Services |

| Starbucks | 1.68% | 14.62% | Travel and Leisure |

| Intercontinental Exc | 0.97% | 14.43% | Financial Services |

| Fedex Corporation | 1.16% | 14.23% | Industrial Transportation |

| Roper Technologies | 0.46% | 13.54% | Electronic and Electrical Equipment |

| Schwab (Charles) Cp | 0.86% | 13.52% | Financial Services |

| Regions Financial | 3.12% | 13.44% | Banks |

| Intuit | 0.42% | 13.19% | Software and Computer Services |

| Vulcan Materials | 0.71% | 13.10% | Construction and Materials |

| Amdocs | 1.92% | 13.02% | Software and Computer Services |

| Motorola Solutions | 1.16% | 13.01% | Technology Hardware and Equip. |

| PNC Financial Svc Gp | 2.49% | 12.81% | Banks |

| Sherwin-Williams | 0.62% | 12.73% | Construction and Materials |

| Interpublic Group Co | 2.88% | 12.59% | Media |

| Skyworks Solutions I | 1.44% | 12.58% | Technology Hardware and Equip. |

| Allstate Corp | 2.75% | 12.53% | Nonlife Insurance |

| Fifth Third Bancorp | 2.76% | 12.46% | Banks |

| Celanese | 1.62% | 12.37% | Chemicals |

| Humana | 0.60% | 12.31% | Health Care Equipment and Services |

| Activision Blizzard | 0.71% | 12.13% | Leisure Goods |

| NextEra Energy Inc | 1.65% | 12.08% | Electricity |

| Amgen Corp | 3.13% | 11.94% | Pharmaceuticals and Biotechnology |

| Illinois Tool Wks | 1.98% | 11.79% | Industrial Engineering |

| Ross Stores | 1.00% | 11.70% | General Retailers |

| Costco Wholesale Cp | 0.56% | 11.67% | General Retailers |

| Mondelez Internation | 2.11% | 11.66% | Food Producers |

| Corning | 2.58% | 11.50% | Technology Hardware and Equip. |

| Kroger | 1.86% | 11.45% | Food and Drug Retailers |

| Xylem Inc. | 0.93% | 11.43% | Industrial Engineering |

| Price (T. Rowe) Grp | 2.20% | 11.33% | Financial Services |

| AbbVie Inc | 3.84% | 11.19% | Pharmaceuticals and Biotechnology |

| Dollar General | 0.71% | 10.88% | General Retailers |

| Huntington Bancshare | 4.02% | 10.88% | Banks |

| FMC Corp | 1.93% | 10.87% | Chemicals |

| Willis Towers Watson | 1.35% | 10.84% | Support Services |

| Hormel Foods | 2.01% | 10.83% | Food Producers |

| Automatic Data Proc. | 1.69% | 10.62% | Support Services |

| Comerica | 3.13% | 10.62% | Banks |

| Oracle Corp. | 1.47% | 10.60% | Software and Computer Services |

| Stryker | 1.04% | 10.49% | Health Care Equipment and Services |

| FNF Group | 3.37% | 10.48% | Financial Services |

| Lauder (Estee) | 0.65% | 10.48% | Personal Goods |

| Equinix Inc | 1.36% | 10.45% | Real Estate Investment Trusts |

| Robert Half Intl | 1.36% | 10.25% | Support Services |

| Keycorp | 3.37% | 10.22% | Banks |

| Fortune Brands Home | 0.97% | 10.21% | Construction and Materials |

| Northrop Grumman Cp | 1.62% | 10.19% | Aerospace and Defense |

| Comcast A | 1.99% | 9.99% | Media |

| American Water Works | 1.28% | 9.97% | Gas Water and Multiutilities |

| Broadridge Financial | 1.40% | 9.95% | Support Services |

| JPMorgan Chase & Co | 2.53% | 9.93% | Banks |

| Accenture Cl A | 0.94% | 9.92% | Support Services |

| Kla-Tencor Corp | 0.98% | 9.91% | Technology Hardware and Equip. |

| Air Products & Chem. | 1.97% | 9.88% | Chemicals |

| Avery Dennison Corp | 1.26% | 9.82% | Chemicals |

| Bank of New York Mel | 2.34% | 9.76% | Financial Services |

| Fastenal Co | 1.75% | 9.74% | Support Services |

| Moodys Corporation | 0.63% | 9.39% | Financial Services |

| Eastman Chemical | 2.51% | 9.36% | Chemicals |

| Microsoft Corp | 0.74% | 9.31% | Software and Computer Services |

| General Dynamics Cp | 2.28% | 9.25% | Aerospace and Defense |

| Discover Financial S | 1.73% | 9.01% | Financial Services |

| Hartford Fin Svc Gp | 2.23% | 9.00% | Nonlife Insurance |

| McCormick & Co | 1.53% | 8.88% | Food Producers |

| Anthem | 0.98% | 8.79% | Health Care Equipment and Services |

| Aon plc | 0.68% | 8.74% | Nonlife Insurance |

| Crown Castle Intl Co | 2.82% | 8.71% | Real Estate Investment Trusts |

| Abbott Laboratories | 1.28% | 8.70% | Pharmaceuticals and Biotechnology |

| Northern Trust | 2.34% | 8.67% | Financial Services |

| Blackrock Inc | 1.80% | 8.63% | Financial Services |

| Gilead Sciences | 3.91% | 8.63% | Pharmaceuticals and Biotechnology |

| Agilent Technologies | 0.49% | 8.61% | Electronic and Electrical Equipment |

| Ameriprise Financial | 1.50% | 8.55% | Financial Services |

| Brown & Brown | 0.58% | 8.55% | Nonlife Insurance |

| Analog Devices | 1.57% | 8.52% | Technology Hardware and Equip. |

| State Street Corp. | 2.45% | 8.51% | Financial Services |

| Marsh & Mclennan | 1.23% | 8.49% | Nonlife Insurance |

| Pulte Group | 1.05% | 8.37% | Household Goods and Home Constr. |

| Lilly (Eli) & Co | 1.23% | 8.23% | Pharmaceuticals and Biotechnology |

| Thermo Fisher Scient | 0.16% | 8.16% | Health Care Equipment and Services |

| Masco Corp | 1.34% | 8.15% | Construction and Materials |

| Apple Inc. | 0.50% | 8.13% | Technology Hardware and Equip. |

| US Bancorp | 3.28% | 8.00% | Banks |

| Honeywell Intl Inc | 1.88% | 7.97% | General Industrials |

| Medtronic plc | 2.44% | 7.94% | Health Care Equipment and Services |

| PPG Industries | 1.37% | 7.83% | Chemicals |

| Ametek Inc | 0.54% | 7.72% | Electronic and Electrical Equipment |

| Lockheed Martin Corp | 3.15% | 7.70% | Aerospace and Defense |

| Quest Diagnostics | 1.43% | 7.66% | Health Care Equipment and Services |

| SEI Invest Co | 1.31% | 7.65% | Financial Services |

| Sempra Energy | 3.33% | 7.61% | Gas Water and Multiutilities |

| Expeditors Intl Wash | 0.86% | 7.57% | Industrial Transportation |

| Prologis | 1.50% | 7.47% | Real Estate Investment Trusts |

| Cisco Systems | 2.34% | 7.41% | Technology Hardware and Equip. |

| Duke Realty | 1.71% | 7.23% | Real Estate Investment Trusts |

| Republic Services | 1.32% | 7.13% | Support Services |

| NetApp | 2.17% | 7.00% | Technology Hardware and Equip. |

| Paychex | 1.93% | 7.00% | Support Services |

| McKesson | 0.76% | 6.95% | Food and Drug Retailers |

| CMS Energy Corp | 2.67% | 6.89% | Electricity |

| Whirlpool Corp | 2.39% | 6.77% | Household Goods and Home Constr. |

| Hershey Company | 1.86% | 6.64% | Food Producers |

| Prudential Financial | 4.25% | 6.56% | Life Insurance |

| Westlake Chemical | 1.23% | 6.54% | Chemicals |

| WEC Energy Group | 2.79% | 6.48% | Gas Water and Multiutilities |

| AES Corp. | 2.48% | 6.42% | Electricity |

| Alliant Energy | 2.62% | 6.33% | Electricity |

| Sysco Corp | 2.39% | 6.33% | Food and Drug Retailers |

| Waste Mgmt Inc | 1.38% | 6.28% | Support Services |

| Eversource Energy | 2.65% | 6.22% | Electricity |

| Western Union | 5.27% | 6.18% | Financial Services |

| CSX Corp | 0.99% | 6.09% | Industrial Transportation |

| Xcel Energy | 2.70% | 6.05% | Electricity |

| Amer. Express Co | 1.05% | 6.00% | Financial Services |

| Pepsico | 2.48% | 5.97% | Beverages |

| Hasbro | 2.67% | 5.87% | Leisure Goods |

| Rockwell Automation | 1.28% | 5.84% | Industrial Engineering |

| J M Smucker | 2.92% | 5.81% | Food Producers |

| Ecolab | 0.87% | 5.73% | Chemicals |

| Clorox | 2.66% | 5.71% | Household Goods and Home Constr. |

| First Republic Bank | 0.43% | 5.66% | Banks |

| Intel Corp | 2.70% | 5.64% | Technology Hardware and Equip. |

| Johnson & Johnson | 2.48% | 5.64% | Pharmaceuticals and Biotechnology |

| Travelers Cos Inc. | 2.25% | 5.62% | Nonlife Insurance |

| Essex Prop Trust | 2.37% | 5.54% | Real Estate Investment Trusts |

| LyondellBasell Indus | 4.90% | 5.50% | Chemicals |

| Martin Merietta Mate | 0.55% | 5.50% | Construction and Materials |

| Grainger (W W) | 1.25% | 5.41% | Support Services |

| Pfizer | 2.64% | 5.40% | Pharmaceuticals and Biotechnology |

| McDonalds Corp | 2.06% | 5.39% | Travel and Leisure |

| M&T Bank | 3.13% | 5.34% | Banks |

| Cummins | 2.66% | 5.30% | Industrial Engineering |

| Church & Dwight | 0.99% | 5.26% | Household Goods and Home Constr. |

| Amer. Elec Power Co | 3.51% | 5.21% | Electricity |

| Hunt (JB) Transport | 0.59% | 5.17% | Industrial Transportation |

| Qualcomm | 1.49% | 5.16% | Technology Hardware and Equip. |

| C.H. Robinson Ww | 2.04% | 5.10% | Industrial Transportation |

| Pinnacle W Capl Cp | 4.82% | 5.10% | Electricity |

| Cincinnati Fin Cp | 2.21% | 5.03% | Nonlife Insurance |

| Omnicom Group | 3.82% | 5.02% | Media |

| Assurant | 1.75% | 4.97% | Life Insurance |

| Becton Dickinson | 1.38% | 4.97% | Health Care Equipment and Services |

| Nisource | 3.19% | 4.97% | Gas Water and Multiutilities |

| Gentex Corp | 1.38% | 4.96% | Automobiles and Parts |

| United Parcel Service (UPS) | 1.90% | 4.94% | Industrial Transportation |

| Stanley Black & Deck | 1.68% | 4.87% | Household Goods and Home Constr. |

| Eaton Corp PLC | 1.76% | 4.68% | General Industrials |

| Digital Realty Trust | 2.62% | 4.64% | Real Estate Investment Trusts |

| Merck & Co | 3.60% | 4.59% | Pharmaceuticals and Biotechnology |

| MMM Company | 3.33% | 4.56% | General Industrials |

| Ameren Corp | 2.47% | 4.52% | Gas Water and Multiutilities |

| Genuine Parts | 2.33% | 4.46% | Automobiles and Parts |

| Public Svc Entp Grp | 3.06% | 4.46% | Electricity |

| Intl Flavours & Frag | 2.10% | 4.41% | Chemicals |

| Everest Re Group | 2.26% | 4.12% | Nonlife Insurance |

| Arthur J Gallagher | 1.13% | 4.11% | Nonlife Insurance |

| Realty Income | 4.13% | 4.11% | Real Estate Investment Trusts |

| Kimberly-Clark | 3.19% | 4.00% | Personal Goods |

| Regency Centers | 3.32% | 3.99% | Real Estate Investment Trusts |

| Target Corp | 1.56% | 3.97% | General Retailers |

| Applied Materials | 0.61% | 3.77% | Technology Hardware and Equip. |

| Metlife | 3.07% | 3.73% | Life Insurance |

| Coca-Cola | 2.84% | 3.72% | Beverages |

| Garmin Ltd | 1.97% | 3.70% | Technology Hardware and Equip. |

| Procter & Gamble | 2.13% | 3.59% | Household Goods and Home Constr. |

| CVS Health Corporati | 1.94% | 3.53% | Food and Drug Retailers |

| Avalonbay Communitie | 2.52% | 3.37% | Real Estate Investment Trusts |

| Southern Co | 3.85% | 3.27% | Electricity |

| IBM | 4.91% | 3.24% | Software and Computer Services |

| Exelon Corporation | 2.65% | 3.20% | Electricity |

| Chubb Ltd | 1.66% | 3.07% | Nonlife Insurance |

| RenaissanceRe | 0.85% | 2.98% | Nonlife Insurance |

| Chevron | 4.57% | 2.95% | Oil and Gas Producers |

| Ace Ltd | 1.66% | 2.87% | Nonlife Insurance |

| Cons Edison Holding | 3.63% | 2.85% | Electricity |

| Philip Morris Intern | 5.26% | 2.84% | Tobacco |

| Duke Energy Corp | 3.76% | 2.76% | Gas Water and Multiutilities |

| Colgate-Palmolive | 2.11% | 2.43% | Personal Goods |

| Entergy Corp | 3.59% | 2.25% | Electricity |

| Kellogg | 3.60% | 2.22% | Food Producers |

| Dover Corp | 1.10% | 2.20% | Industrial Engineering |

| Juniper Networks | 2.24% | 2.16% | Technology Hardware and Equip. |

| Bristol Myers Squibb | 3.14% | 2.08% | Pharmaceuticals and Biotechnology |

| Verizon Comms. | 4.93% | 2.08% | Fixed Line Telecommunications |

| Nucor Corp | 1.75% | 1.70% | Industrial Metals and Mining |

| AT&T | 8.46% | 1.62% | Fixed Line Telecommunications |

| BorgWarner | 1.51% | 1.54% | Automobiles and Parts |

| Seagate Technology | 2.48% | 1.25% | Technology Hardware and Equip. |

| General Mills | 3.03% | 1.23% | Food Producers |

| Emerson Electric | 2.22% | 1.22% | Electronic and Electrical Equipment |

| PPL Corporation | 5.52% | 1.14% | Electricity |

| Iron Mountain | 4.73% | 1.10% | Real Estate Investment Trusts |

| Microchip Technology | 1.07% | 0.69% | Technology Hardware and Equip. |

*Average annual growth of the dividend over five years excluding the highest value and growing its dividend since 2015. In addition, companies in losses, excessive payout, with negative cash flow or significant stock market falls in the last year that suggest that this dividend growth rate is not sustainable are excluded.

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.