08-31-2023

| HKD/share | |

| Price | 42.75 |

| Dividend | 0.59 |

| Earnings | 17.81 |

| Cash-flow | 11.25 |

| Book value | 213.75 |

| Equity | 161.91 |

Hangzhou Tigermed Co is part of Health Care Equip. and Services business, which is part of Health Care industry. Hangzhou Tigermed Co is a company from China, and his stocks are publicly traded.

Hangzhou Tigermed Co stock dividend

Hangzhou Tigermed Co paid a total dividend of 73 million HKD last year, for a market value of 5,258 millions (Market Cap 5,264 millions). Hangzhou Tigermed Co dividend per share is 0.59 HKD, and his stock market price 42.75 HKD.

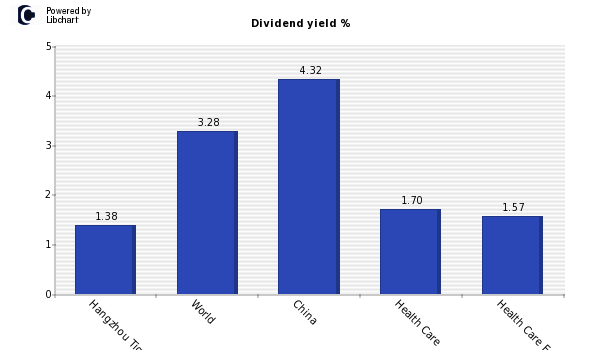

According to the chart below, where dividend yield is displayed, Hangzhou Tigermed Co has a dividend yield of 1.38%, lower than the amount offered by both the market average and companies from China. It is also lower than average of Health Care industry. This low dividend yield might has several explanations: company overpriced, expanding their business,...

In addition, you should compare Hangzhou Tigermed Co stocks dividend with other Health Care Equip. and Services companies or other of the highest China dividend stocks list.

Hangzhou Tigermed Co Dividend Payout

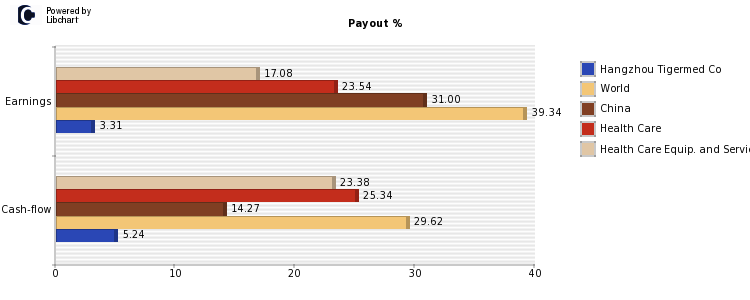

About the ability of Hangzhou Tigermed Co to maintain his current dividend of HKD 0.59 per share, an amount that accounts for 1.38%, we should study its payout ratio both on earnings and on cash-flows (see chart below). Hangzhou Tigermed Co payout on ernings is currently 3.31%, which is lower than the market average and companies of Health Care industry, which are 39.34% and 23.54% respectively. Both figures lead us to believe that there is confidence that Hangzhou Tigermed Cocan maintain his current dividend.

The payout on earnings should be complemented with the payout on cash flow since it is this last amount the one which can be distributed to shareholders. Cash flow per share of Hangzhou Tigermed Co is HKD 11.25 per share, which is higher than the dividend per share paid by the company of HKD 0.59, so the company generates enough cash to maintain his dividend in the future.

The following figure shows payout ratios over earnings and cashflow of Hangzhou Tigermed Co, compared againt world market average, China companies, Health Care industry and Health Care Equip. and Services sector companies.

Hangzhou Tigermed Co Dividend History

Below you will find a table with the historical evolution of Hangzhou Tigermed Co's dividend stock, both in percentage and in HKD, its Payout on Earnings and the number of shares (in case there is an split, number shares altered the dividend per share).

| Year | Yield | HKD | Paypout | Shares* |

| Present | 1.38% | 0.59 | 3.31% | 123 |

| 2022 | 0.64% | 0.58 | 2.19% | 123 |

*In millions

Hangzhou Tigermed Co Stock performance

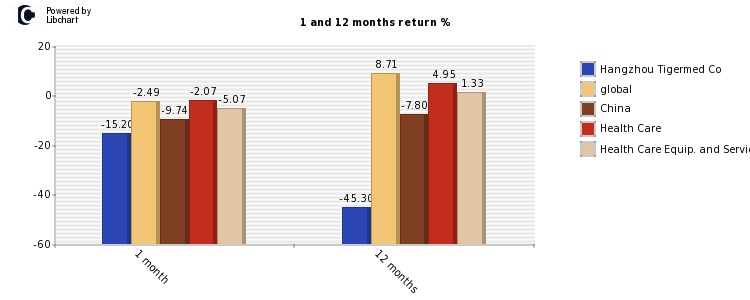

Finally, last moth Hangzhou Tigermed Co showed a return of -15.20% compared to a worldwide -2.49% average, and a -2.07% of Health Care firms. Over the last year, the company obtained a -45.30% versus a worldwide performance of a 8.71%. More detailed information can be seen in the following graph for China and Health Care Equip. and Services firms.