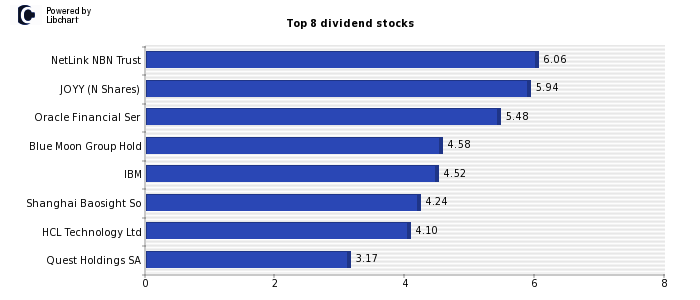

Highest Dividend yield of Software and Computer Services stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

Dividend yield of Software and Computer Services companies ordered from highest ( 1.19% average).

As you can noticed, NetLink NBN Trust (Singapore) - JOYY (N Shares) (China) - Oracle Financial Ser (India) - are companies currently paying a higher dividend, offering yields of - 6.06% - 5.94% - 5.48% - respectively.

Finally, there are also other Software and Computer Services stocks that offer a very interesting dividend yield such as - Blue Moon Group Hold (China) - IBM (USA) - Shanghai Baosight So (China) - HCL Technology Ltd (India) - .

Coming up next, we show the full list of Software and Computer Services stocks, including their dividend return and payout.

Full Software and Computer Services Dividend stocks list

| Company | Dividend | Payout | Country |

| NetLink NBN Trust | 6.06% | 166.67% | Singapore |

| JOYY (N Shares) | 5.94% | 87.55% | China |

| Oracle Financial Ser | 5.48% | 107.96% | India |

| Blue Moon Group Hold | 4.58% | 154.55% | China |

| IBM | 4.52% | 146.90% | USA |

| Shanghai Baosight So | 4.24% | 76.92% | China |

| HCL Technology Ltd | 4.10% | 77.49% | India |

| Quest Holdings SA | 3.17% | 48.78% | Greece |

| Hewlett Packard Ente | 2.83% | 53.93% | USA |

| United Inter Na | 2.82% | 15.48% | Germany |

| Tech Mahindra | 2.66% | 54.53% | India |

| Net One | 2.59% | 41.96% | Japan |

| NortonLifeLock Inc | 2.47% | 19.23% | USA |

| Trend Micro | 2.44% | 69.78% | Japan |

| SK Holdings | 2.42% | 6.78% | Korea |

| Infosys | 2.37% | 57.35% | India |

| Samsung SDS | 2.25% | 21.37% | Korea |

| Square Enix Holdings | 2.24% | 30.02% | Japan |

| Tecmo Koei Holdings | 2.21% | 51.05% | Japan |

| Nihon Unisys Ltd | 2.12% | 30.32% | Japan |

| TechnoPro Holdings | 2.10% | 52.71% | Japan |

| Mphasis | 2.06% | 55.61% | India |

| SCSK | 2.06% | 39.14% | Japan |

| Autohome | 2.01% | 26.13% | China |

| Totvs SA Ord | 1.95% | 54.55% | Brazil |

| Amdocs | 1.95% | 32.95% | USA |

| Otsuka | 1.92% | 59.13% | Japan |

| Sage Group | 1.92% | 54.29% | UK |

| NS Solutions | 1.90% | 29.83% | Japan |

| Cap Gemini | 1.89% | 32.34% | France |

| Itochu Techno Soluti | 1.87% | 51.43% | Japan |

| SS&C Technologies Holding | 1.67% | 19.24% | USA |

| Cognizant Tech Sltns | 1.62% | 23.82% | USA |

| SAP | 1.59% | 78.54% | Germany |

| Oracle Corp Japan | 1.59% | 39.75% | Japan |

| Scout24 | 1.57% | 50.51% | Germany |

| Temenos Group | 1.57% | 36.30% | Switzerland |

| CyberAgent | 1.51% | 29.29% | Japan |

| Leidos Holdings | 1.48% | 21.56% | USA |

| Wipro | 1.47% | 27.03% | India |

| Tata Consultancy Ser | 1.46% | 42.05% | India |

| Hexagon B | 1.46% | 27.88% | Sweden |

| Bechtle | 1.45% | 28.89% | Germany |

| Oracle Corp. | 1.33% | 35.71% | USA |

| Coforge | 1.28% | 52.10% | India |

| Yahoo Japan | 1.27% | 16.76% | Japan |

| Larsen & Toubro Info | 1.16% | 39.32% | India |

| LTIMindtree | 1.16% | 39.32% | India |

| Internet Initiative | 1.15% | 21.73% | Japan |

| NTT Data Corp. | 1.12% | 11.20% | Japan |

| Obic Business Consul | 1.12% | 46.93% | Japan |

| CDW | 1.12% | 23.69% | USA |

| Nomura Research Inst | 1.08% | 26.03% | Japan |

| Reply | 1.06% | 18.12% | Italy |

| Altium | 1.05% | 64.56% | Australia |

| Obic | 0.99% | 44.35% | Japan |

| Tata Elxsi | 0.84% | 49.82% | India |

| GMO Internet | 0.84% | 15.96% | Japan |

| Microsoft Corp | 0.83% | 27.06% | USA |

| Baycurrent Consultin | 0.82% | 28.70% | Japan |

| Tencent Holdings (P | 0.74% | 9.71% | China |

| Persistent Systems | 0.74% | 28.64% | India |

| Nemetschek SE | 0.71% | 26.47% | Germany |

| Elms | 0.71% | 47.60% | Saudi Arabia |

| NAVER | 0.62% | 25.05% | Korea |

| Justsystems | 0.60% | 8.70% | Japan |

| Intuit | 0.58% | 29.10% | USA |

| Dassault Systemes | 0.57% | 20.59% | France |

| Travelsky Tech H | 0.41% | 16.22% | China |

| Wisetech Global | 0.19% | 15.85% | Australia |

| Constellation Softwa | 0.19% | 7.22% | Canada |

| Daum Kakao | 0.12% | 1.62% | Korea |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.