Best Israel dividend stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

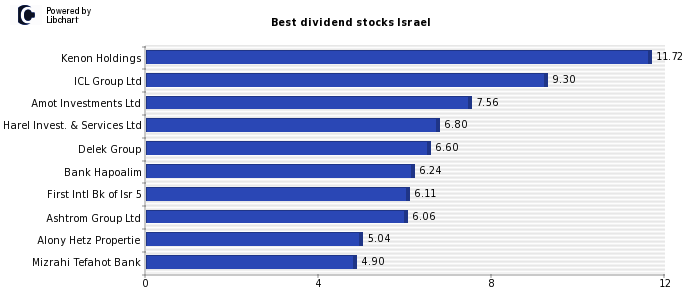

High Israel dividend stocks: Publicly traded companies ordered by their dividend yield ( 3.66% average)

As shown above, Kenon Holdings (Electricity) - ICL Group Ltd (Chemicals) - Amot Investments Ltd (Real Estate Investment and Services) - are the companies that currently pay a higher dividend in Israel, offering yields of - 11.72% - 9.30% - 7.56% - respectively.

Finally, there are also other Israel stocks that offer a very interesting dividend yield such as - Harel Invest. & Services Ltd (Nonlife Insurance) - Delek Group (Oil and Gas Producers) - Bank Hapoalim (Banks) - First Intl Bk of Isr 5 (Banks) - .

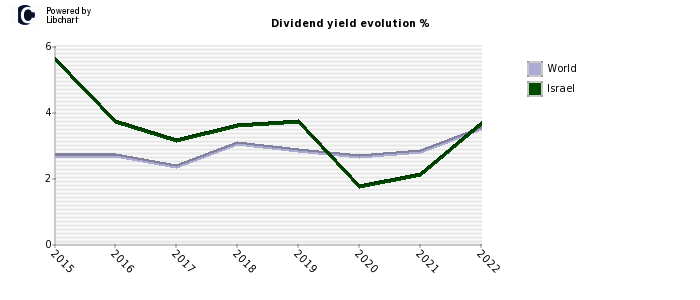

Average Israel dividend yield evolution

Full Highest Dividend stocks Israel list

Coming up next, we show the full list of the highest Israel dividend yielding stocks, including their dividend return and payout.

| Company | Dividend | Payout | P/E | ROE | Sector |

| Kenon Holdings | 11.72% | 46.88% | 4.0 | 18.8% | Electricity |

| ICL Group Ltd | 9.30% | 37.19% | 4.0 | 44.5% | Chemicals |

| Amot Investments Ltd | 7.56% | 54.40% | 7.2 | 14.3% | Real Estate Investment and Services |

| Harel Invest. & Services Ltd | 6.80% | 33.22% | 4.9 | 13.7% | Nonlife Insurance |

| Delek Group | 6.60% | 14.52% | 2.2 | 81.4% | Oil and Gas Producers |

| Bank Hapoalim | 6.24% | 39.96% | 6.4 | 14.7% | Banks |

| First Intl Bk of Isr 5 | 6.11% | 53.14% | 8.7 | 17.3% | Banks |

| Ashtrom Group Ltd | 6.06% | 34.50% | 5.7 | 21.0% | Construction and Materials |

| Alony Hetz Propertie | 5.04% | -93.59% | -18.5 | -3.7% | Real Estate Investment and Services |

| Mizrahi Tefahot Bank | 4.90% | 35.25% | 7.2 | 20.1% | Banks |

| Israel Discount Bank | 4.68% | 31.34% | 6.7 | 15.1% | Banks |

| Gav-Yam Lands | 4.48% | 25.00% | 5.6 | 24.6% | Real Estate Investment and Services |

| Melisron | 4.41% | 35.73% | 8.1 | 15.1% | Real Estate Investment and Services |

| Mivne Real Estate | 4.10% | 21.89% | 5.4 | 17.2% | Real Estate Investment and Services |

| Bank Leumi | 3.80% | 22.36% | 5.9 | 16.9% | Banks |

| Bezeq | 3.79% | 47.62% | 12.3 | 85.2% | Fixed Line Telecommunications |

| Energix Renewable | 3.71% | 102.33% | 27.4 | 12.3% | Electricity |

| Israel Corporation | 3.43% | 8.92% | 2.6 | 47.3% | Chemicals |

| Phoenix Holdings | 3.08% | 19.02% | 6.2 | 15.7% | Nonlife Insurance |

| Strauss Group | 3.02% | 264.89% | 88.2 | 4.4% | Food Producers |

| Azrieli Group | 2.83% | 39.05% | 13.8 | 8.4% | Real Estate Investment and Services |

| Elco | 2.10% | 11.55% | 5.5 | 25.9% | Household Goods and Home Constr. |

| Electra (Israel) Ltd | 1.45% | 18.99% | 13.1 | 31.3% | Construction and Materials |

| Elbit Systems | 1.02% | 30.89% | 30.3 | 12.4% | Aerospace and Defense |

| Shapir Engineering | 0.75% | 17.86% | 23.4 | 14.9% | Construction and Materials |

| Airport City Ltd | 0.00% | 0.00% | 11.8 | 6.7% | Real Estate Investment and Services |

| Big Shopping Centers | 0.00% | 0.00% | 6.3 | 15.1% | Real Estate Investment and Services |

| Shikun & Binui | 0.00% | 0.00% | 39.1 | 3.3% | Construction and Materials |

| Teva Pharmaceutical | 0.00% | 0.00% | -7.6 | -18.3% | Pharmaceuticals and Biotechnology |

| Shufersal Ltd. | 0.00% | 0.00% | 56.0 | 2.7% | Food and Drug Retailers |

| Nice Systems | 0.00% | 0.00% | 38.4 | 12.8% | Technology Hardware and Equip. |

| Tower Semiconductor | 0.00% | 0.00% | 13.7 | 15.2% | Technology Hardware and Equip. |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.