08-31-2023

| HKD/share | |

| Price | 23.30 |

| Dividend | 0.00 |

| Earnings | -0.30 |

| Cash-flow | 0.00 |

| Book value | 3.82 |

| Equity | 4.11 |

ZhongAn Online P&C Insur. is part of Nonlife Insurance business, which is part of Financials industry. ZhongAn Online P&C Insur. is a company from China, and his stocks are publicly traded.

ZhongAn Online P&C Insur. stock dividend

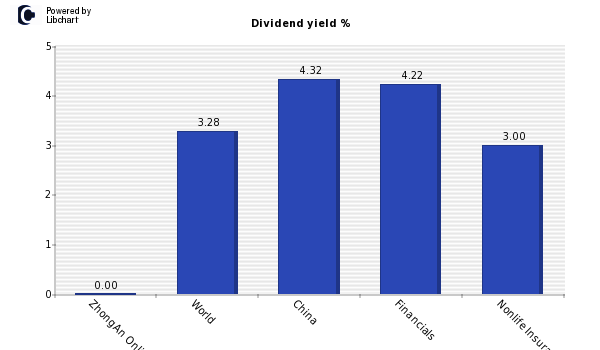

ZhongAn Online P&C Insur. paid a total dividend of 0 million HKD last year, for a market value of 34,251 millions (Market Cap 17,390 millions). ZhongAn Online P&C Insur. dividend per share is 0.00 HKD, and his stock market price 23.30 HKD.

According to the chart below where dividend yield is displayed, ZhongAn Online P&C Insur., has a dividend yield of 0%, amount in contrast with the positive dividend offered by both the market average and companies from China, Financials industry, and Nonlife Insurance sector. This lack of dividends of ZhongAn Online P&C Insur. might harm the evolution of share price if the company is not clearly expanding his business.

In addition, you should compare ZhongAn Online P&C Insur. stocks dividend with other Nonlife Insurance companies or other of the highest China dividend stocks list.

ZhongAn Online P&C Insur. Dividend Payout

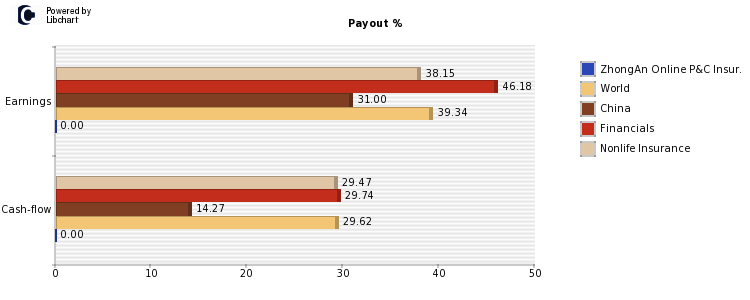

About the ability of ZhongAn Online P&C Insur. to maintain his current dividend of HKD 0.00 per share, an amount that accounts for 0.00%, we should study its payout ratio both on earnings and on cash-flows (see chart below). ZhongAn Online P&C Insur. payout on ernings is currently 0.00%, which is lower than the market average and companies in his industry and sector.

The following figure shows payout ratios over earnings and cashflow of ZhongAn Online P&C Insur., compared againt world market average, China companies, Financials industry and Nonlife Insurance sector companies.

ZhongAn Online P&C Insur. Dividend History

Below you will find a table with the historical evolution of ZhongAn Online P&C Insur.'s dividend stock, both in percentage and in HKD, its Payout on Earnings and the number of shares (in case there is an split, number shares altered the dividend per share).

| Year | Yield | HKD | Paypout | Shares* |

| Present | 0.00% | 0.00 | 0.00% | 1,470 |

| 2022 | 0.00% | 0.00 | 0.00% | 1,470 |

| 2021 | 0.00% | 0.00 | 0.00% | 1,470 |

| 2020 | 0.00% | 0.00 | 0.00% | 1,470 |

| 2019 | 0.00% | 0.00 | 0.00% | 1,470 |

| 2018 | 0.00% | 0.00 | 0.00% | 1,470 |

*In millions

ZhongAn Online P&C Insur. Stock performance

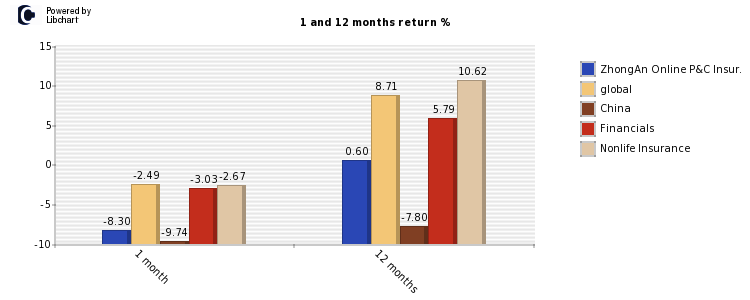

Finally, last moth ZhongAn Online P&C Insur. showed a return of -8.30% compared to a worldwide -2.49% average, and a -3.03% of Financials firms. Over the last year, the company obtained a 0.60% versus a worldwide performance of a 8.71%. More detailed information can be seen in the following graph for China and Nonlife Insurance firms.