Best ASX 20 dividend stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

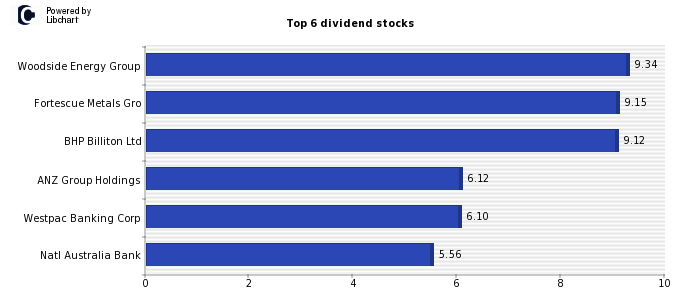

ASX 20 best dividend stocks and full list ranked by diviend yield (Australia 3.99% average)

As you can see, Woodside Energy Group (Oil and Gas Producers) - Fortescue Metals Gro (Industrial Metals and Mining) - BHP Billiton Ltd (Mining) - are the companies that currently pay a higher dividend in the ASX 20, offering returns of 9.34% - 9.15% - 9.12% - respectively.

Following, we show the ASX 20 Index and the complete list of stocks that comprise it, including their market Cap, payout and dividend return.

Full ASX 20 Dividend stocks list

| Company | Dividend | Payout | Market Cap (mn) | Sector |

| Woodside Energy Group | 9.34% | 70.04% | AUD 69,947 | Oil and Gas Producers |

| Fortescue Metals Gro | 9.15% | 84.12% | AUD 34,060 | Industrial Metals and Mining |

| BHP Billiton Ltd | 9.12% | 177.06% | AUD 225,614 | Mining |

| ANZ Group Holdings | 6.12% | 61.75% | AUD 76,052 | Banks |

| Westpac Banking Corp | 6.10% | 75.28% | AUD 76,582 | Banks |

| Natl Australia Bank | 5.56% | 67.93% | AUD 90,867 | Banks |

| Rio Tinto Ltd. | 5.20% | 50.95% | AUD 41,898 | Mining |

| Amcor | 4.98% | 61.48% | AUD 22,435 | General Industrials |

| Santos | 4.79% | 40.22% | AUD 22,895 | Oil and Gas Producers |

| Commonwealth Bank of | 4.40% | 71.77% | AUD 172,299 | Banks |

| Transurban Group | 4.37% | 175.76% | AUD 40,811 | Industrial Transportation |

| Macquarie Group | 4.22% | 55.28% | AUD 64,487 | Financial Services |

| Coles Group | 4.06% | 71.74% | AUD 21,151 | General Retailers |

| Wesfarmers | 3.55% | 81.62% | AUD 60,954 | General Retailers |

| QBE Insurance Group | 2.94% | 53.01% | AUD 22,318 | Nonlife Insurance |

| Woolworths | 2.73% | 60.12% | AUD 46,451 | Food and Drug Retailers |

| Newcrest Mining | 2.08% | 40.91% | AUD 23,256 | Mining |

| Aristocrat Leisure | 1.37% | 34.15% | AUD 26,794 | Travel and Leisure |

| Goodman Group | 1.28% | 16.57% | AUD 43,089 | Real Estate Investment Trusts |

| CSL | 1.27% | 44.26% | AUD 131,652 | Pharmaceuticals and Biotechnology |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.