Best Switzerland Dividend Growth stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

12-31-2021

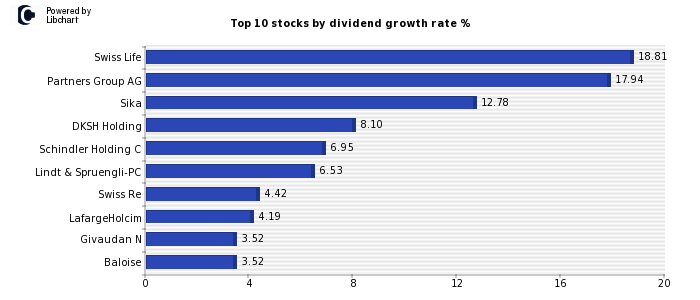

Best Switzerland Dividend growth stocks ordered by 5y average dividend growth rate

As shown above, Swiss Life (Life Insurance) - Partners Group AG (Financial Services) - Sika (Construction and Materials) - are the companies that currently offer a highest dividend growth rate, offering dividend yields of - 18.81% - 17.94% - 12.78% - respectively.

Finally, there are also other Switzerland zone stocks that offer a very interesting dividend growth rate such as - DKSH Holding (Support Services) - Schindler Holding C (Industrial Engineering) - Lindt & Spruengli-PC (Food Producers) - Swiss Re (Nonlife Insurance) - .

You can also access the best SMI dividend stocks,and the highest swiss dividend yielding stocks lists

Coming up next, we show the full list of the best 5 year average dividend growth stocks traded in Switzerland, including their dividend yield and 5y average dividend growth rate.

Full Swiss dividend growth stocks list

| Company | Dividend | 5y avg. Growth* | Sector |

| Swiss Life | 3.76% | 18.81% | Life Insurance |

| Partners Group AG | 1.82% | 17.94% | Financial Services |

| Sika | 0.66% | 12.78% | Construction and Materials |

| DKSH Holding | 2.59% | 8.10% | Support Services |

| Schindler Holding C | 1.63% | 6.95% | Industrial Engineering |

| Lindt & Spruengli-PC | 0.87% | 6.53% | Food Producers |

| Swiss Re | 6.54% | 4.42% | Nonlife Insurance |

| LafargeHolcim | 4.30% | 4.19% | Construction and Materials |

| Baloise | 4.29% | 3.52% | Nonlife Insurance |

| Givaudan N | 1.34% | 3.52% | Chemicals |

| Geberit N | 1.53% | 2.96% | Construction and Materials |

| Nestle | 2.16% | 2.56% | Food Producers |

| Novartis (REGD) | 3.74% | 2.13% | Pharmaceuticals and Biotechnology |

| PSP Swiss Property | 3.21% | 1.76% | Real Estate Investment and Services |

| Roche Hldgs (GENUS) | 2.40% | 1.68% | Pharmaceuticals and Biotechnology |

| ABB | 2.29% | 1.58% | Industrial Engineering |

*Average annual growth of the dividend over five years excluding the highest value and growing its dividend since 2015. In addition, companies in losses, excessive payout, with negative cash flow or significant stock market falls in the last year that suggest that this dividend growth rate is not sustainable are excluded.

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.