Best Japan Dividend Growth stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

12-31-2021

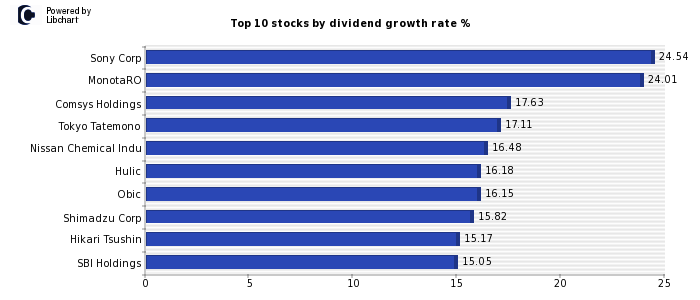

Best Japan Dividend growth stocks ordered by 5y average dividend growth rate

As shown above, Sony Corp (Leisure Goods) - MonotaRO (Support Services) - Comsys Holdings (Construction and Materials) - are the companies that currently offer a highest dividend growth rate, offering dividend yields of - 24.54% - 24.01% - 17.63% - respectively.

Finally, there are also other Japan zone stocks that offer a very interesting dividend growth rate such as - Tokyo Tatemono (Real Estate Investment and Services) - Nissan Chemical Indu (Chemicals) - Hulic (Real Estate Investment and Services) - Obic (Software and Computer Services) - .

Coming up next, we show the full list of the best 5 year average dividend growth stocks traded in Japan, including their dividend yield and 5y average dividend growth rate.

| Company | Dividend | 5y avg. Growth* | Sector |

| Sony Corp | 0.41% | 24.54% | Leisure Goods |

| MonotaRO | 0.55% | 24.01% | Support Services |

| Comsys Holdings | 3.51% | 17.63% | Construction and Materials |

| Tokyo Tatemono | 2.86% | 17.11% | Real Estate Investment and Services |

| Nissan Chemical Indu | 1.62% | 16.48% | Chemicals |

| Hulic | 3.48% | 16.18% | Real Estate Investment and Services |

| Obic | 0.91% | 16.15% | Software and Computer Services |

| Shimadzu Corp | 0.80% | 15.82% | Industrial Engineering |

| Hikari Tsushin | 2.70% | 15.17% | Mobile Telecommunications |

| SBI Holdings | 4.15% | 15.05% | Financial Services |

| Shin-Etsu Chemical | 1.46% | 14.97% | Chemicals |

| Uni-Charm | 0.72% | 14.43% | Personal Goods |

| Zenkoku Hosho | 2.34% | 13.75% | Financial Services |

| Sompo Japan Nipponko | 4.01% | 13.46% | Nonlife Insurance |

| Nitori Holdings | 0.79% | 12.88% | General Retailers |

| Yakult Honsha | 1.03% | 12.49% | Food Producers |

| Asahi Group Holdings | 2.44% | 12.34% | Beverages |

| Taiyo Nippon Sanso | 1.27% | 12.27% | Chemicals |

| Nippon Paint | 0.72% | 11.69% | Chemicals |

| Kagome Co | 1.24% | 11.38% | Beverages |

| Takara Holdings | 1.72% | 11.35% | Beverages |

| SCSK | 2.04% | 11.26% | Software and Computer Services |

| Iida Group Holdings | 3.29% | 11.06% | Real Estate Investment and Services |

| Sumitomo Rlty & Devt | 1.27% | 10.64% | Real Estate Investment and Services |

| Kandenko | 3.27% | 10.56% | Construction and Materials |

| Lion Corp | 1.56% | 10.52% | Personal Goods |

| KDDI Corp | 3.57% | 10.10% | Mobile Telecommunications |

| Shionogi | 1.35% | 10.08% | Pharmaceuticals and Biotechnology |

| Aeon Mall | 2.74% | 9.93% | Real Estate Investment and Services |

| Kao | 2.39% | 9.76% | Personal Goods |

| Matsumotokiyoshi Hol | 1.64% | 9.07% | Food and Drug Retailers |

| Kobayashi Pharmaceut | 0.90% | 8.85% | Pharmaceuticals and Biotechnology |

| Hitachi Transport Sy | 1.04% | 8.75% | Industrial Transportation |

| Alfresa Holdings | 3.52% | 8.55% | Pharmaceuticals and Biotechnology |

| Minebea | 0.98% | 8.53% | Electronic and Electrical Equipment |

| Kansai Paint | 1.20% | 8.10% | Chemicals |

| Mitsubishi Corp | 3.78% | 7.85% | Support Services |

| Hakuhodo DY Holdings | 1.57% | 7.66% | Media |

| Sugi Holdings | 1.15% | 7.39% | Food and Drug Retailers |

| Nomura Real Estate H | 3.21% | 7.31% | Real Estate Investment and Services |

| Sanwa Holdings | 2.77% | 7.31% | Construction and Materials |

| Fuji Film Holdings | 1.26% | 7.23% | Technology Hardware and Equip. |

| Medipal Holdings | 1.95% | 7.11% | Pharmaceuticals and Biotechnology |

| Kinden | 2.11% | 7.02% | Construction and Materials |

| Kyowa Hakko Kirin | 1.47% | 6.98% | Pharmaceuticals and Biotechnology |

| Nitto Denko Corp | 2.36% | 6.85% | Chemicals |

| Yokogawa Electric | 1.64% | 6.50% | Electronic and Electrical Equipment |

| NISSIN FOODS HOLDING | 1.37% | 6.48% | Food Producers |

| Sekisui House | 3.32% | 6.34% | Household Goods and Home Constr. |

| Daiwa House Industry | 3.66% | 6.19% | Household Goods and Home Constr. |

| Kurita Water Inds | 1.28% | 6.09% | Industrial Engineering |

| Nisshin Seifun Group | 2.23% | 6.08% | Food Producers |

| Kirin Holdings | 3.52% | 5.66% | Beverages |

| TS TECH | 3.36% | 5.29% | Automobiles and Parts |

| Astellas Pharmaceuti | 2.46% | 5.02% | Pharmaceuticals and Biotechnology |

| Rinnai Corp | 1.30% | 4.92% | Household Goods and Home Constr. |

| Ono Pharmaceutical | 1.94% | 4.70% | Pharmaceuticals and Biotechnology |

| Secom | 2.19% | 4.62% | Support Services |

| Aeon | 1.33% | 4.45% | General Retailers |

| Yamato Holdings | 1.96% | 4.45% | Industrial Transportation |

| NTT Data Corp. | 0.75% | 4.25% | Software and Computer Services |

| Seven & I Holdings | 1.96% | 3.54% | General Retailers |

| Resona Holdings | 4.69% | 3.18% | Banks |

| Cosmos Pharmaceutica | 0.49% | 2.43% | Food and Drug Retailers |

| Yamazaki Baking | 1.44% | 2.25% | Food Producers |

*Average annual growth of the dividend over five years excluding the highest value and growing its dividend since 2015. In addition, companies in losses, excessive payout, with negative cash flow or significant stock market falls in the last year that suggest that this dividend growth rate is not sustainable are excluded.

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.