Best Canada Dividend Growth stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

12-31-2021

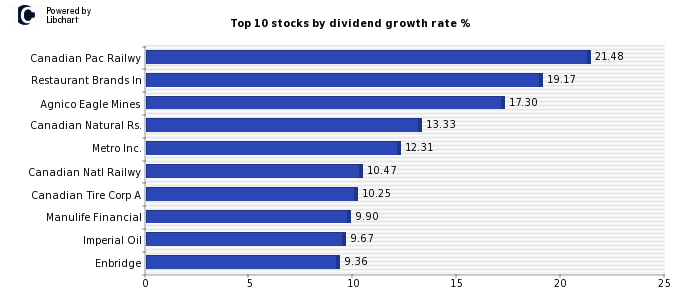

Best Canada Dividend growth stocks ordered by 5y average dividend growth rate

As shown above, Canadian Pac Railwy (Industrial Transportation) - Restaurant Brands In (Travel and Leisure) - Agnico Eagle Mines (Mining) - are the companies that currently offer a highest dividend growth rate, offering dividend yields of - 21.48% - 19.17% - 17.30% - respectively.

Finally, there are also other Canada zone stocks that offer a very interesting dividend growth rate such as - Canadian Natural Rs. (Oil and Gas Producers) - Metro Inc. (Food and Drug Retailers) - Canadian Natl Railwy (Industrial Transportation) - Canadian Tire Corp A (General Retailers) - .

Coming up next, we show the full list of the best 5 year average dividend growth stocks traded in Canada, including their dividend yield and 5y average dividend growth rate.

| Company | Dividend | 5y avg. Growth* | Sector |

| Canadian Pac Railwy | 0.84% | 21.48% | Industrial Transportation |

| Restaurant Brands In | 3.49% | 19.17% | Travel and Leisure |

| Agnico Eagle Mines | 2.63% | 17.30% | Mining |

| Canadian Natural Rs. | 4.40% | 13.33% | Oil and Gas Producers |

| Metro Inc. | 1.49% | 12.31% | Food and Drug Retailers |

| Canadian Natl Railwy | 1.58% | 10.47% | Industrial Transportation |

| Canadian Tire Corp A | 2.59% | 10.25% | General Retailers |

| Manulife Financial | 5.47% | 9.90% | Life Insurance |

| Imperial Oil | 2.37% | 9.67% | Oil and Gas Producers |

| Enbridge | 6.76% | 9.36% | Oil Equipment Services and Distrib. |

| Intact Financial | 2.21% | 9.19% | Nonlife Insurance |

| Telus Corporation | 4.40% | 7.80% | Fixed Line Telecommunications |

| Power Corp Canada | 4.74% | 7.63% | Life Insurance |

| Magna International | 2.12% | 7.24% | Automobiles and Parts |

| National Bank of Can | 3.61% | 6.53% | Banks |

| Canadian Utilities A | 4.79% | 6.31% | Gas Water and Multiutilities |

| Great-West Lifeco | 5.16% | 6.13% | Life Insurance |

| Bank of Nova Scotia | 4.47% | 5.19% | Banks |

| Sun Life Financial | 3.12% | 5.18% | Life Insurance |

| BCE Inc | 5.32% | 5.05% | Fixed Line Telecommunications |

| Royal Bank Of Canada | 3.22% | 4.54% | Banks |

| Saputo | 2.53% | 3.72% | Food Producers |

*Average annual growth of the dividend over five years excluding the highest value and growing its dividend since 2015. In addition, companies in losses, excessive payout, with negative cash flow or significant stock market falls in the last year that suggest that this dividend growth rate is not sustainable are excluded.

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.