Highest Dividend yield of Industrial Transportation stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

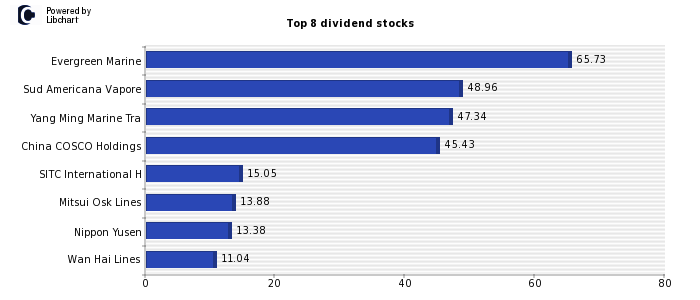

Dividend yield of Industrial Transportation companies ordered from highest ( 5.96% average).

As you can noticed, Evergreen Marine (Taiwan) - Sud Americana Vapore (Colombia) - Yang Ming Marine Tra (Taiwan) - are companies currently paying a higher dividend, offering yields of - 65.73% - 48.96% - 47.34% - respectively.

Finally, there are also other Industrial Transportation stocks that offer a very interesting dividend yield such as - China COSCO Holdings (China) - SITC International H (Hong-Kong) - Mitsui Osk Lines (Japan) - Nippon Yusen (Japan) - .

Coming up next, we show the full list of Industrial Transportation stocks, including their dividend return and payout.

Full Industrial Transportation Dividend stocks list

| Company | Dividend | Payout | Country |

| Evergreen Marine | 65.73% | 46.01% | Taiwan |

| Sud Americana Vapore | 48.96% | 29.38% | Colombia |

| Yang Ming Marine Tra | 47.34% | 37.87% | Taiwan |

| China COSCO Holdings | 45.43% | 9.09% | China |

| SITC International H | 15.05% | 42.15% | Hong-Kong |

| Mitsui Osk Lines | 13.88% | 24.98% | Japan |

| Nippon Yusen | 13.38% | 26.76% | Japan |

| Wan Hai Lines | 11.04% | 15.45% | Taiwan |

| China Shipping H | 10.88% | 25.00% | China |

| Sinotrans H | 10.55% | 50.00% | China |

| Hutchison Port Holdi | 10.37% | 100.00% | Singapore |

| A P Moller - Maersk | 9.19% | 9.19% | Denmark |

| Kerry Logistics Netw | 8.96% | 32.20% | Hong-Kong |

| China Mercht Hldg RC | 8.74% | 41.00% | China |

| Shenzhen Expressway | 7.84% | 29.24% | China |

| Anhui Expressway H | 7.68% | 41.26% | China |

| China Railway Signal | 7.03% | 43.90% | China |

| Jiangsu Expressway ( | 6.99% | 44.14% | China |

| Zhejiang Express. H | 6.88% | 19.80% | China |

| U-Ming Marine Transp | 6.60% | 57.47% | Taiwan |

| Atlas Arteria | 6.58% | 190.48% | Australia |

| COSCO Pacific (Red C | 5.86% | 37.84% | China |

| CRRC (H) | 5.57% | 43.14% | China |

| Kuehne & Nagel Int | 5.27% | 62.18% | Switzerland |

| Grupo Aerop. Centro Norte | 4.87% | 90.57% | Mexico |

| Grupo Aerop. del Pacifico | 4.67% | 59.30% | Mexico |

| Shenzhen Intl Hldgs | 4.61% | 19.12% | China |

| MISC | 4.58% | 78.57% | Malaysia |

| Westports Holdings | 4.47% | 69.57% | Malaysia |

| Transurban Group | 4.37% | 175.76% | Australia |

| Deutsche Post | 4.29% | 39.53% | Germany |

| International Contai | 4.13% | 45.85% | Philippines |

| Aurizon Holdings | 4.11% | 88.24% | Australia |

| Daimler Truck | 4.00% | 37.57% | Germany |

| Vopak Nv | 3.91% | -110.17% | Netherlands |

| United Parcel Service (UPS) | 3.83% | 46.72% | USA |

| ARAMEX | 3.75% | 90.91% | U. Arab Emirates |

| BOC Aviation | 3.54% | 0.00% | Hong-Kong |

| Qatar Gas Transport | 3.51% | 50.00% | Qatar |

| Hyundai Glovis | 3.30% | 17.82% | Korea |

| Aena S.A. | 3.28% | 73.57% | Spain |

| Groupe Eurotunnel | 3.24% | 98.04% | France |

| Mainfreight | 3.09% | 45.82% | New Zealand |

| Sankyu | 2.95% | 35.11% | Japan |

| Indian Railway Finan | 2.85% | 29.61% | India |

| Kamigumi | 2.74% | 40.28% | Japan |

| C.H. Robinson Ww | 2.70% | 28.60% | USA |

| CCR SA | 2.64% | 11.91% | Brazil |

| Seino Holdings | 2.64% | 53.60% | Japan |

| Norfolk Sthn Corp | 2.63% | 37.59% | USA |

| Aeroports de Paris | 2.57% | 45.56% | France |

| SG Holdings | 2.42% | 25.41% | Japan |

| Union Pacific Corp | 2.36% | 45.34% | USA |

| Mitsubishi Logistics | 2.32% | 25.75% | Japan |

| Qube Holdings | 2.30% | 70.00% | Australia |

| SIA Engineering | 2.29% | 83.33% | Singapore |

| Vamos Locacao de Cam | 2.23% | 38.81% | Brazil |

| Grupo Aerop. del Sureste | 2.14% | 24.82% | Mexico |

| Canadian Natl Railwy | 2.08% | 41.44% | Canada |

| China Shipping Dev H | 1.98% | 41.03% | China |

| Fedex Corporation | 1.93% | 31.48% | USA |

| Container Corporatio | 1.78% | 61.96% | India |

| Jasa Marga | 1.76% | 10.91% | Indonesia |

| Yamato Holdings | 1.68% | 36.29% | Japan |

| CSX Corp | 1.46% | 21.46% | USA |

| Bangkok Expressway a | 1.39% | 48.00% | Thailand |

| Flughafen Zurich | 1.32% | 32.30% | Switzerland |

| Expeditors Intl Wash | 1.18% | 15.72% | USA |

| Singapore Post Ltd | 1.17% | 100.00% | Singapore |

| Reece | 1.13% | 32.86% | Australia |

| Bollore | 1.10% | 4.62% | France |

| Hunt (JB) Transport | 0.89% | 17.51% | USA |

| Canadian Pac Railwy | 0.71% | 20.05% | Canada |

| Adani Ports and Spec | 0.63% | 18.58% | India |

| CJ Korea Express | 0.63% | 4.60% | Korea |

| Malaysia Airports | 0.53% | 7.55% | Malaysia |

| Dsv B | 0.50% | 7.85% | Denmark |

| Old Dominion Freight Line | 0.37% | 12.61% | USA |

| Rumo Logistica SA | 0.30% | 19.44% | Brazil |

| Odet Financiere | 0.25% | 0.68% | France |

| Japan Airport Termin | 0.23% | 0.00% | Japan |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.