Best Taiwan dividend stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

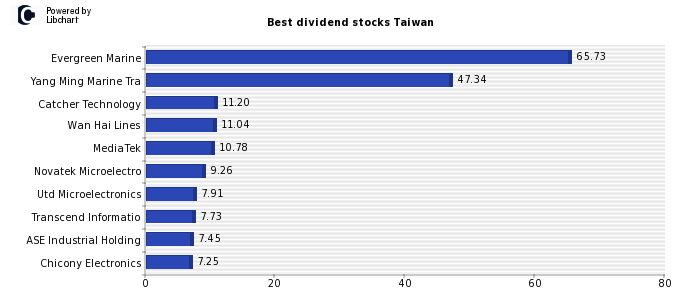

High Taiwan dividend stocks: Publicly traded companies ordered by their dividend yield ( 4.68% average)

As shown above, Evergreen Marine (Industrial Transportation) - Yang Ming Marine Tra (Industrial Transportation) - Catcher Technology (Technology Hardware and Equip.) - are the companies that currently pay a higher dividend in Taiwan, offering yields of - 65.73% - 47.34% - 11.20% - respectively.

Finally, there are also other Taiwan stocks that offer a very interesting dividend yield such as - Wan Hai Lines (Industrial Transportation) - MediaTek (Technology Hardware and Equip.) - Novatek Microelectro (Technology Hardware and Equip.) - Utd Microelectronics (Technology Hardware and Equip.) - .

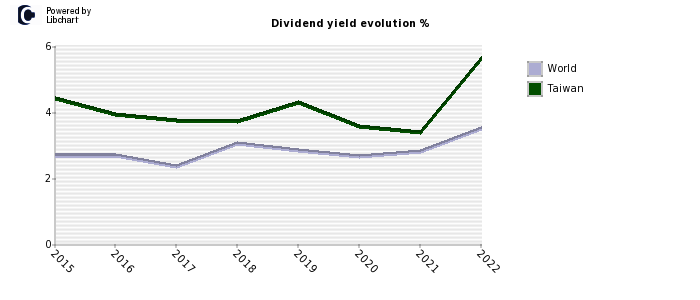

Average Taiwan dividend yield evolution

Full Highest Dividend stocks Taiwan list

Coming up next, we show the full list of the highest Taiwan dividend yielding stocks, including their dividend return and payout.

| Company | Dividend | Payout | P/E | ROE | Sector |

| Evergreen Marine | 65.73% | 46.01% | 0.7 | 76.1% | Industrial Transportation |

| Yang Ming Marine Tra | 47.34% | 37.87% | 0.8 | 62.7% | Industrial Transportation |

| Catcher Technology | 11.20% | 132.16% | 11.8 | 6.9% | Technology Hardware and Equip. |

| Wan Hai Lines | 11.04% | 15.45% | 1.4 | 50.4% | Industrial Transportation |

| MediaTek | 10.78% | 98.10% | 9.1 | 28.4% | Technology Hardware and Equip. |

| Novatek Microelectro | 9.26% | 79.63% | 8.6 | 41.4% | Technology Hardware and Equip. |

| Utd Microelectronics | 7.91% | 49.86% | 6.3 | 29.2% | Technology Hardware and Equip. |

| Transcend Informatio | 7.73% | 98.25% | 12.7 | 12.5% | Technology Hardware and Equip. |

| ASE Industrial Holding | 7.45% | 58.10% | 7.8 | 23.5% | Technology Hardware and Equip. |

| Chicony Electronics | 7.25% | 76.84% | 10.6 | 22.4% | Technology Hardware and Equip. |

| Powertech Technology | 7.02% | 61.08% | 8.7 | 17.1% | Technology Hardware and Equip. |

| U-Ming Marine Transp | 6.60% | 57.47% | 8.7 | 15.1% | Industrial Transportation |

| Vanguard Intnl Semic | 6.59% | 48.08% | 7.3 | 38.2% | Technology Hardware and Equip. |

| Realtek Semiconducto | 6.46% | 77.52% | 12.0 | 41.6% | Technology Hardware and Equip. |

| Zhen Ding Technology | 6.20% | 39.09% | 6.3 | 16.2% | Electronic and Electrical Equipment |

| Formosa Taffeta | 5.88% | 74.26% | 12.6 | 5.8% | Personal Goods |

| Asia Cement | 5.76% | 66.28% | 11.5 | 7.7% | Construction and Materials |

| Sino-American Silico | 5.75% | 58.06% | 10.1 | 30.2% | Technology Hardware and Equip. |

| Synnex Technology In | 5.73% | 37.23% | 6.5 | 23.2% | Technology Hardware and Equip. |

| Formosa Plastics Cor | 5.28% | 71.79% | 13.6 | 9.7% | Chemicals |

| Pegatron | 5.13% | 70.30% | 13.7 | 8.7% | Technology Hardware and Equip. |

| Hon Hai Precision In | 4.98% | 50.77% | 10.2 | 10.3% | Electronic and Electrical Equipment |

| Quanta Computer | 4.97% | 166.01% | 33.4 | 17.8% | Technology Hardware and Equip. |

| Far Eastern New Cent | 4.80% | 48.39% | 10.1 | 7.2% | Personal Goods |

| Walsin Lihwa | 4.74% | 34.55% | 7.3 | 16.9% | Electronic and Electrical Equipment |

| Taiwan Secom | 4.74% | 85.32% | 18.0 | 22.4% | Support Services |

| Taiwan Mobile | 4.61% | 95.98% | 20.8 | 24.3% | Mobile Telecommunications |

| Far EasTone Telecom | 4.60% | 66.74% | 14.5 | 24.7% | Mobile Telecommunications |

| Pou Chen | 4.55% | 30.02% | 6.6 | 10.4% | Personal Goods |

| Nan Ya Plastics | 4.54% | 71.77% | 15.8 | 8.4% | Chemicals |

| AU Optronics | 4.49% | -29.63% | -6.6 | -10.0% | Technology Hardware and Equip. |

| Uni-president Enterp | 4.46% | 99.06% | 22.2 | 15.0% | Food Producers |

| China Motor | 4.45% | -28.51% | -6.4 | -20.6% | Automobiles and Parts |

| Unimicron Technology | 4.31% | 40.55% | 9.4 | 40.9% | Electronic and Electrical Equipment |

| Shanghai Commercial | 4.23% | 57.88% | 13.7 | 9.2% | Banks |

| CTBC Financial Holdi | 4.19% | 60.98% | 14.5 | 8.1% | Banks |

| Taiwan Fertilizer | 4.19% | 91.58% | 21.8 | 5.1% | Chemicals |

| Micro-Star Internati | 4.14% | 55.88% | 13.5 | 20.9% | Technology Hardware and Equip. |

| Eternal Chemical | 4.13% | 53.81% | 13.0 | 10.8% | Chemicals |

| Acer | 4.10% | 85.71% | 20.9 | 8.2% | Technology Hardware and Equip. |

| Feng TAY Enterprise | 4.09% | 74.43% | 18.2 | 42.4% | Personal Goods |

| Chunghwa Telecom | 4.05% | 84.68% | 20.9 | 11.3% | Fixed Line Telecommunications |

| Giant Manufacturing | 3.98% | 50.55% | 12.7 | 19.8% | Leisure Goods |

| Yulon Nissan Motor C | 3.88% | 89.69% | 23.1 | 12.7% | Automobiles and Parts |

| China Steel | 3.77% | 87.72% | 23.2 | 5.4% | Industrial Metals and Mining |

| Compal Electronics | 3.76% | 67.42% | 17.9 | 6.9% | Technology Hardware and Equip. |

| Asustek Computer Inc | 3.73% | 74.20% | 19.9 | 6.8% | Technology Hardware and Equip. |

| Powerchip Semiconduc | 3.69% | 19.22% | 5.2 | 26.8% | Technology Hardware and Equip. |

| Nien Made Enterprise | 3.68% | 50.41% | 13.7 | 32.7% | General Retailers |

| Lite-On Technology | 3.65% | 82.51% | 22.6 | 18.6% | Electronic and Electrical Equipment |

| Largan Precision | 3.54% | 42.48% | 12.0 | 15.3% | Leisure Goods |

| Far Eastern Internat | 3.54% | 45.05% | 12.7 | 7.1% | Banks |

| Cheng Shin Rubber In | 3.53% | 89.74% | 25.4 | 6.1% | Automobiles and Parts |

| Chailease Holding | 3.53% | 37.79% | 10.7 | 21.6% | Financial Services |

| GlobalWafers | 3.49% | 44.67% | 12.8 | 31.1% | Technology Hardware and Equip. |

| SinoPac Fin Holdings | 3.44% | 44.70% | 13.0 | 10.3% | Banks |

| Mega Financial Hldg | 3.43% | 91.11% | 26.6 | 6.0% | Banks |

| Parade Technologies | 3.43% | 47.68% | 13.9 | 32.5% | Technology Hardware and Equip. |

| President Chain Stor | 3.36% | 95.13% | 28.3 | 27.9% | Food and Drug Retailers |

| Eclat Textile | 3.34% | 68.47% | 20.5 | 29.4% | Personal Goods |

| Yuanta Financial Hol | 3.23% | 45.66% | 14.1 | 8.4% | Financial Services |

| Wiwynn | 3.21% | 61.31% | 19.1 | 43.1% | Technology Hardware and Equip. |

| Nanya Technology | 3.20% | 44.47% | 13.9 | 8.4% | Technology Hardware and Equip. |

| Genius Electronic | 3.13% | 41.01% | 13.1 | 17.9% | Electronic and Electrical Equipment |

| Chang Hwa Commercial | 3.10% | 51.92% | 16.6 | 6.7% | Banks |

| TECO Electric & Mach | 3.01% | 88.76% | 29.6 | 4.3% | Household Goods and Home Constr. |

| Voltronic Power Tech | 3.00% | 85.80% | 28.6 | 63.3% | Technology Hardware and Equip. |

| First Financial Hold | 2.95% | 50.32% | 17.0 | 9.4% | Banks |

| Hua Nan Fin Hldgs | 2.88% | 45.38% | 15.8 | 9.2% | Banks |

| Foxconn Technology | 2.87% | 51.78% | 18.0 | 4.1% | Electronic and Electrical Equipment |

| Delta Electronics | 2.84% | 69.86% | 24.6 | 21.4% | Electronic and Electrical Equipment |

| Taishin Financial Ho | 2.75% | 44.95% | 16.4 | 7.1% | Banks |

| HIWIN Technologies C | 2.68% | 43.40% | 16.2 | 13.8% | Industrial Engineering |

| Inventec Co. | 2.66% | 85.23% | 32.0 | 10.8% | Technology Hardware and Equip. |

| Capital Securities | 2.64% | 97.50% | 36.7 | 2.4% | Financial Services |

| Advantech | 2.64% | 70.99% | 26.9 | 26.8% | Technology Hardware and Equip. |

| Momo.com | 2.62% | 93.74% | 35.8 | 37.6% | General Retailers |

| EVA Airways | 2.54% | 57.97% | 22.8 | 8.6% | Travel and Leisure |

| E Ink Holdings | 2.47% | 50.90% | 20.6 | 25.7% | Electronic and Electrical Equipment |

| Walsin Technology | 2.44% | 64.96% | 26.6 | 4.1% | Electronic and Electrical Equipment |

| Fubon Financial Hold | 2.36% | 40.76% | 17.3 | 6.0% | Life Insurance |

| Taiwan High Speed Rail | 2.25% | 21.82% | 9.7 | 25.4% | Construction and Materials |

| Wistron Corp | 2.22% | 64.84% | 29.2 | 13.3% | Technology Hardware and Equip. |

| Yageo | 2.06% | 17.92% | 8.7 | 23.3% | Electronic and Electrical Equipment |

| China Airlines | 2.04% | 90.20% | 44.1 | 4.3% | Travel and Leisure |

| ASMedia Technology | 2.03% | 51.14% | 25.2 | 17.1% | Technology Hardware and Equip. |

| Taiwan Semiconductor | 2.00% | 27.80% | 13.9 | 40.1% | Technology Hardware and Equip. |

| Cathay Fin Hldg | 1.97% | 35.71% | 18.1 | 4.7% | Life Insurance |

| Win Semiconductors | 1.84% | 54.59% | 29.7 | 5.7% | Technology Hardware and Equip. |

| Taiwan Cooperative F | 1.81% | 34.29% | 18.8 | 9.1% | Banks |

| Accton Technology | 1.57% | 50.99% | 32.5 | 45.7% | Technology Hardware and Equip. |

| Silergy | 1.57% | 27.65% | 17.6 | 22.9% | Technology Hardware and Equip. |

| Formosa Chem & Fib | 1.53% | 46.57% | 30.4 | 3.3% | Chemicals |

| Airtac International | 1.45% | 44.81% | 30.9 | 16.2% | Industrial Engineering |

| Taiwan Cement | 1.43% | 58.82% | 41.0 | 2.9% | Construction and Materials |

| Formosa Petrochemica | 1.39% | 72.85% | 52.4 | 4.3% | Oil and Gas Producers |

| eMemory Technology | 1.13% | 94.82% | 83.9 | 59.5% | Electronic and Electrical Equipment |

| Yulon Motor Co. | 1.12% | -21.63% | -19.4 | -9.0% | Automobiles and Parts |

| E.Sun Financial Hold | 0.75% | 17.14% | 23.2 | 8.4% | Banks |

| Taiwan Business Bank | 0.73% | 7.94% | 10.6 | 10.1% | Banks |

| Hotai Motor | 0.29% | -5.69% | -19.6 | -33.3% | General Retailers |

| Shin Kong Financial | 0.00% | 0.00% | 71.0 | 0.8% | Life Insurance |

| Ruentex Development | 0.00% | 0.00% | 12.7 | 9.4% | Real Estate Investment and Services |

| China Dvlpmt Fin Hld | 0.00% | 0.00% | 11.2 | 6.8% | Financial Services |

| Taiwan Glass Industr | 0.00% | 0.00% | -79.8 | -1.4% | Construction and Materials |

| HTC Corporation | 0.00% | 0.00% | -12.8 | -12.9% | Technology Hardware and Equip. |

| Innolux | 0.00% | 0.00% | -4.7 | -10.0% | Technology Hardware and Equip. |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.