Best FTSE-100 dividend stocks

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

08-31-2023

FTSE-100 best dividend stocks and full list ranked by diviend yield (UK 3.98% average)

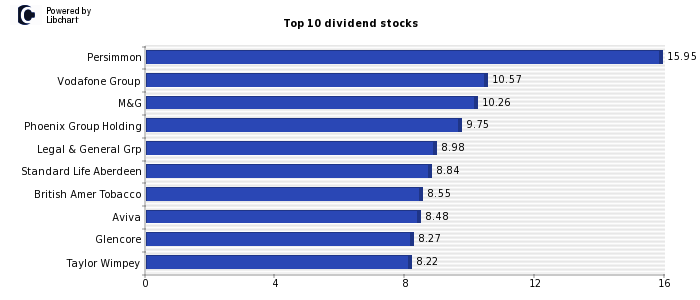

Users can unhurriedly observe Persimmon (Household Goods and Home Constr.) - Vodafone Group (Mobile Telecommunications) - M&G (Financial Services) - are the companies that currently pay a higher dividend in the FTSE 100, offering returns of 15.95% - 10.57% - 10.26% - respectively.

The FTSE 100 index is composed of the 100 main stocks of the London Stock Exchange. FTSE is an acronym for Financial Times Stock Exchange. The index was developed with a base price level of 1000 and started its quotation in January 3, 1984. The capitalization of companies in the index is 70% of the total value of London stock market, and stocks are weighted by capitalization criteria. It is reviewed quarterly, the first Friday of March, June, September and December and sessions take place from Monday to Friday.

You can also access the list of the best dividend growth stocks in the UK in the last 5 years.

Next, we present the FTSE 100 Index and the complete list of stocks and dividend yields that comprise it.

Full FTSE 100 Highst Dividend stocks list

| Company | Dividend | Payout | Market Cap (mn) | Sector |

| Persimmon | 15.95% | 97.14% | GBP 3,385 | Household Goods and Home Constr. |

| Vodafone Group | 10.57% | 15.38% | GBP 15,989 | Mobile Telecommunications |

| M&G | 10.26% | -29.41% | GBP 4,152 | Financial Services |

| Phoenix Group Holding | 9.75% | -38.06% | GBP 3,824 | Life Insurance |

| Legal & General Grp | 8.98% | 51.28% | GBP 12,963 | Life Insurance |

| Standard Life Aberdeen | 8.84% | -71.43% | GBP 3,254 | Financial Services |

| British Amer Tobacco | 8.55% | 70.89% | GBP 58,300 | Tobacco |

| Aviva | 8.48% | -84.21% | GBP 10,377 | Life Insurance |

| Glencore | 8.27% | 30.70% | GBP 52,499 | Mining |

| Taylor Wimpey | 8.22% | 50.00% | GBP 4,003 | Household Goods and Home Constr. |

| Imperial Tobacco Gp | 7.92% | 66.67% | GBP 16,417 | Tobacco |

| Barratt Developments | 7.92% | 67.92% | GBP 4,427 | Household Goods and Home Constr. |

| British Land Co | 7.00% | -20.54% | GBP 2,991 | Real Estate Investment Trusts |

| Rio Tinto | 6.73% | 52.48% | GBP 53,037 | Mining |

| Natwest Group | 6.73% | 39.47% | GBP 12,750 | Banks |

| BT Group | 6.66% | 25.81% | GBP 8,032 | Fixed Line Telecommunications |

| Land Securities Grp | 6.47% | -46.43% | GBP 4,440 | Real Estate Investment Trusts |

| HSBC Hldgs | 5.99% | 52.24% | GBP 116,473 | Banks |

| St.James Place | 5.99% | 69.74% | GBP 4,777 | Life Insurance |

| Lloyds Banking Group | 5.95% | 22.22% | GBP 27,887 | Banks |

| SSE | 5.95% | 0.00% | GBP 17,725 | Electricity |

| Intermediate Capital | 5.73% | 98.73% | GBP 3,758 | Financial Services |

| National Grid | 5.60% | 67.90% | GBP 36,362 | Gas Water and Multiutilities |

| Kingfisher | 5.30% | 41.38% | GBP 4,534 | General Retailers |

| Hargreaves Lansdown | 5.27% | 85.11% | GBP 2,876 | Financial Services |

| Barclays | 5.23% | 20.00% | GBP 22,821 | Banks |

| Schroders | 5.22% | 70.97% | GBP 3,464 | Financial Services |

| Smith (DS) | 5.19% | 35.56% | GBP 3,994 | General Industrials |

| WPP | 5.14% | 54.17% | GBP 7,965 | Media |

| Anglo American | 4.98% | 38.04% | GBP 25,331 | Mining |

| Sainsbury (J) | 4.85% | 81.25% | GBP 4,679 | Food and Drug Retailers |

| Beazley | 4.84% | 123.81% | GBP 3,611 | Nonlife Insurance |

| United Utilities Gro | 4.81% | 127.78% | GBP 6,455 | Gas Water and Multiutilities |

| Mondi | 4.75% | 31.63% | GBP 6,361 | Forestry and Paper |

| Johnson Matthey | 4.72% | 47.83% | GBP 2,932 | Chemicals |

| BP | 4.46% | 0.00% | GBP 84,111 | Oil and Gas Producers |

| Severn Trent | 4.45% | 162.12% | GBP 6,036 | Gas Water and Multiutilities |

| DCC | 4.33% | 41.93% | GBP 4,273 | Support Services |

| Tesco | 4.10% | 78.57% | GBP 19,186 | Food and Drug Retailers |

| Endeavour Mining | 4.06% | -361.11% | GBP 2,945 | Mining |

| GSK | 4.00% | 14.11% | GBP 55,837 | Pharmaceuticals and Biotechnology |

| Shell Plc | 3.94% | 18.52% | GBP 164,833 | Oil and Gas Producers |

| Unilever | 3.72% | 109.49% | GBP 101,275 | Personal Goods |

| Segro | 3.65% | -16.88% | GBP 8,898 | Real Estate Investment Trusts |

| Unite Group | 3.48% | 39.76% | GBP 3,255 | Real Estate Investment Trusts |

| Antofagasta | 3.44% | 39.68% | GBP 5,007 | Mining |

| Reckitt Benckiser Gr | 3.28% | 54.84% | GBP 40,825 | Household Goods and Home Constr. |

| Admiral Group | 3.28% | 62.60% | GBP 7,189 | Nonlife Insurance |

| Berkeley Group Holdi | 3.17% | 29.86% | GBP 4,277 | Household Goods and Home Constr. |

| Smith & Nephew | 3.01% | 80.00% | GBP 9,338 | Health Care Equip. and Services |

| Coca-Cola HBC AG | 2.98% | 70.10% | GBP 4,473 | Beverages |

| Next | 2.95% | 36.52% | GBP 8,584 | General Retailers |

| Hiscox | 2.90% | 152.63% | GBP 3,343 | Nonlife Insurance |

| Burberry Group | 2.79% | 43.88% | GBP 8,183 | Personal Goods |

| Howden Joinery Group | 2.78% | 30.43% | GBP 3,895 | Support Services |

| Electrocomponents | 2.75% | 31.82% | GBP 3,591 | Support Services |

| Ferguson | 2.70% | 40.78% | GBP 26,323 | Support Services |

| BAE Systems | 2.68% | 45.76% | GBP 30,694 | Aerospace and Defense |

| Group 3i | 2.66% | 11.16% | GBP 18,974 | Financial Services |

| Tate & Lyle | 2.62% | 48.72% | GBP 2,833 | Food Producers |

| Pearson | 2.61% | 37.29% | GBP 5,988 | Media |

| Intertek Group | 2.56% | 49.77% | GBP 6,674 | Support Services |

| B&M European Value Retail | 2.53% | 42.86% | GBP 5,382 | General Retailers |

| Diageo | 2.47% | 47.62% | GBP 71,651 | Beverages |

| Smiths Group | 2.45% | 12.94% | GBP 5,768 | General Industrials |

| CRH | 2.35% | 24.49% | GBP 33,478 | Construction and Materials |

| Standard Chartered | 2.29% | 17.98% | GBP 16,459 | Banks |

| Hikma Pharmaceutical | 2.28% | 47.17% | GBP 3,530 | Pharmaceuticals and Biotechnology |

| Bunzl | 2.22% | 34.81% | GBP 9,543 | Support Services |

| Assoc British Foods | 2.21% | 44.44% | GBP 6,808 | Food Producers |

| AstraZeneca | 2.20% | 60.41% | GBP 157,453 | Pharmaceuticals and Biotechnology |

| RELX | 2.17% | 45.90% | GBP 48,847 | Media |

| ConvaTec Group | 2.17% | 62.50% | GBP 3,788 | Health Care Equip. and Services |

| Whitbread | 2.16% | 50.68% | GBP 6,927 | Travel and Leisure |

| Centrica | 1.98% | -27.27% | GBP 8,587 | Gas Water and Multiutilities |

| Croda International | 1.96% | 21.91% | GBP 7,694 | Chemicals |

| InterContinental Hotels | 1.93% | 61.17% | GBP 10,216 | Travel and Leisure |

| Sage Group | 1.92% | 54.29% | GBP 9,941 | Software and Computer Services |

| Compass Group | 1.86% | 42.53% | GBP 34,710 | Travel and Leisure |

| Weir Group | 1.79% | 33.67% | GBP 4,748 | Industrial Engineering |

| IMI | 1.76% | 24.76% | GBP 3,857 | Industrial Engineering |

| Informa | 1.72% | 38.24% | GBP 10,277 | Media |

| Prudential | 1.60% | 27.78% | GBP 26,574 | Life Insurance |

| Experian | 1.58% | 36.67% | GBP 25,294 | Support Services |

| Rightmove | 1.52% | 37.50% | GBP 4,553 | Media |

| Spirax-Sarco Engineering | 1.50% | 43.80% | GBP 7,448 | Industrial Engineering |

| GVC Holdings | 1.50% | 42.50% | GBP 7,337 | Travel and Leisure |

| Ashtead Group | 1.43% | 24.01% | GBP 24,086 | Support Services |

| Auto Trader Group | 1.39% | 30.77% | GBP 5,433 | Media |

| LSE Group PLC | 1.36% | 22.79% | GBP 34,957 | Financial Services |

| Melrose Industries | 1.36% | 43.75% | GBP 6,855 | Construction and Materials |

| Rentokil Initial | 1.31% | 57.14% | GBP 15,156 | Support Services |

| Haleon | 1.30% | 30.77% | GBP 16,872 | Pharmaceuticals and Biotechnology |

| Dechra Pharmaceutica | 1.19% | 37.82% | GBP 4,198 | Pharmaceuticals and Biotechnology |

| Halma | 0.94% | 25.64% | GBP 8,115 | Electronic and Electrical Equipment |

| JD Sports Fashion | 0.55% | 25.00% | GBP 3,575 | General Retailers |

| Paddy Power Betfair | 0.00% | 0.00% | GBP 25,397 | Travel and Leisure |

| Rolls-Royce Holdings | 0.00% | 0.00% | GBP 18,598 | Aerospace and Defense |

| Ocado Group | 0.00% | 0.00% | GBP 5,277 | Food and Drug Retailers |

| Just Eat Takeaway.com | 0.00% | 0.00% | EUR 2,643 | General Retailers |

All rights reserved

information advertisement legal

Part of Enciclopedia Financiera Group

Disclaimer: Information on this site is only for informational purposes. Always consult a professional advisor before investing.